3.

| an advisory vote to consider and take action on the following items:*1.

| the election of four directors; |

| a proposal to ratify the appointment of KPMG LLP as the independent registered public accounting firm of Minerals Technologies Inc. for the 2020 fiscal year; |

3.

| an advisory vote to approve 2019approve 2021 named executive officer compensation; |

| a proposal to approve an amendment of the 2015 Stock Award and Incentive Plan to increase the number of shares reserved and available for awards thereunder; and |

5.

| any other business that properly comes before the meeting, either at the scheduled time or after any adjournment. |

Shareholders of record as of the close of business on March 22, 2022 are entitled to notice of and to vote at the meeting. April 1, 2022 New York, New York | | | By Order of the closeBoard of business on March 17, 2020 are entitled to notice ofDirectors, | | | | | | | | Thomas J. Meek | | | | Senior Vice President, General Counsel,

Secretary and to vote at the meeting.Chief Compliance Officer

March 31, 2020

New York, New York

| | | By Order of the Board of Directors,

| |

| | | | | | | Thomas J. Meek

| | | | Senior Vice President, General Counsel,

Human Resources, Secretary and Chief Compliance Officer

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FORTHE MINERALS TECHNOLOGIES INC. ANNUAL MEETING OF SHAREHOLDERSTO BE HELD ON MAY 13, 2020The 2020 Proxy Statement and 2019 Annual Report to Shareholders are available at:www.proxyvote.com | 1 | Due to concerns relating to the public health impact of the coronavirus outbreak (COVID-19) and related travel, Minerals Technologies Inc. is taking precautions and planning for the possibility that the 2020 Annual Meeting may be held at a different location or solely by means of remote communication (i.e., a virtual-only meeting) and with additional procedures to protect public health and safety. If we determine to hold the 2020 Annual Meeting in this manner, we will announce the decision in advance, and will provide details on how to participate at https://investors.mineralstech.com. We encourage you to check this website prior to the 2020 Annual Meeting if you plan to attend. |

TABLE OF CONTENTS PROXY SUMMARY This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement before voting. For more complete information regarding the Company’s 2019 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

PROXY SUMMARY This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider and you should read the entire proxy statement before voting. For more complete information regarding the Company’s 2021 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. Voting Matters Our Board’s Recommendation | | Item 1. | | | Election of Directors | | |

| | | | 01 | | | Douglas T. Dietrich | | | | | | | 02 | | | Carolyn K. Pittman | | | | | | | Item 2. | | | Ratification of Appointment of Auditors | | | | | | | Item 3. | | | Advisory Vote to Approve 2021 Named Executive Officer Compensation | | | | | | |

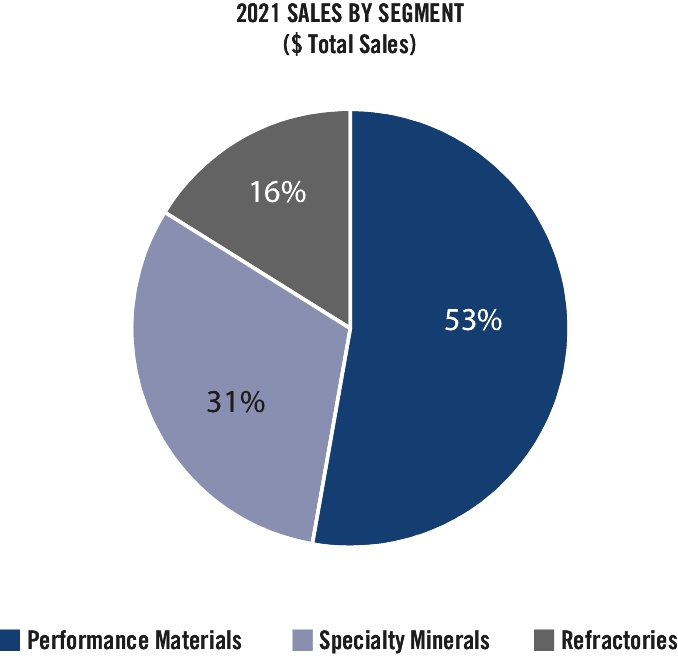

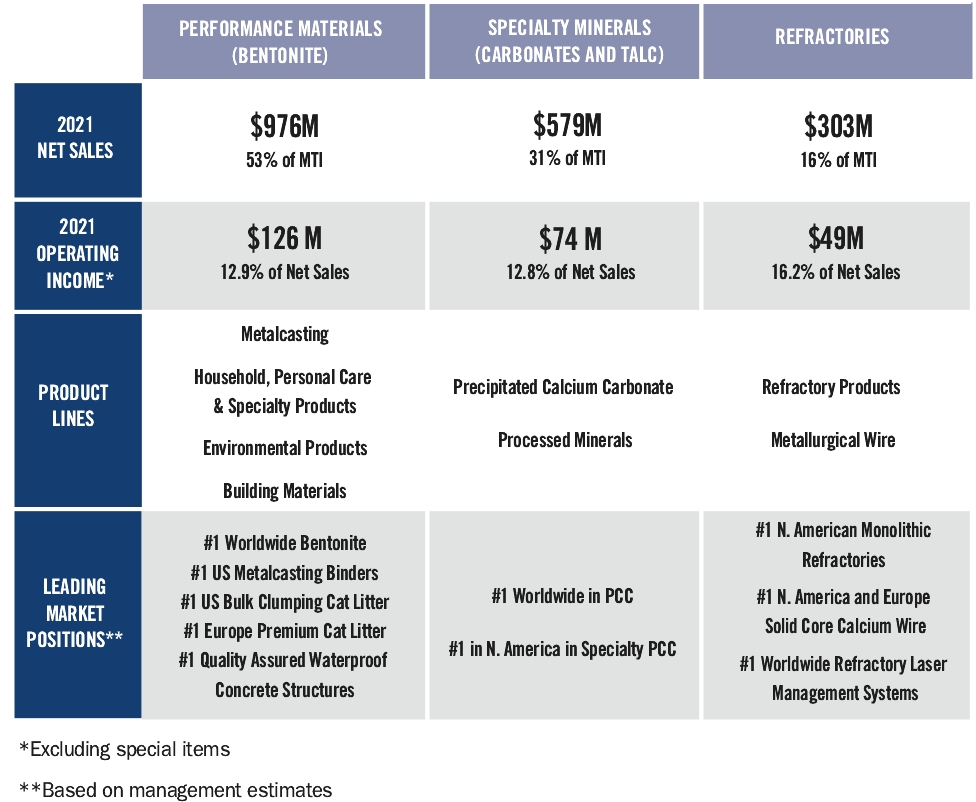

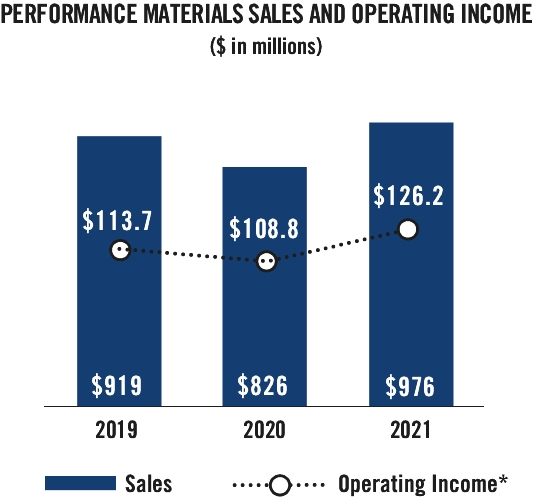

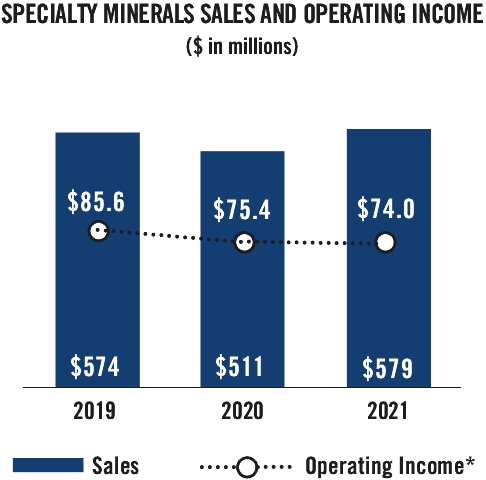

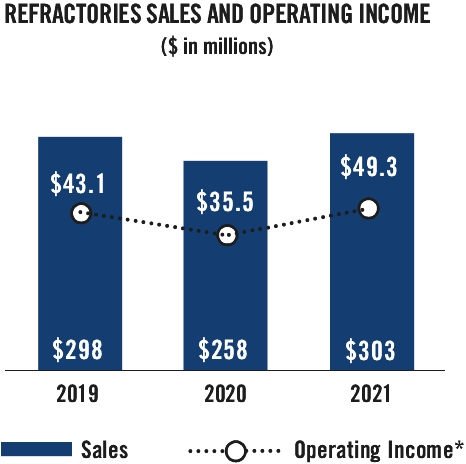

Our Company Minerals Technologies Inc. is a resource- and technology-based company that develops, produces, and markets on a worldwide basis a broad range of specialty mineral, mineral-based and synthetic mineral products and supporting systems and services. The Company has three reportable segments: Performance Materials, Specialty Minerals and Refractories. The Performance Materials segment is a leading global supplier of a wide range of bentonite-based and synthetic materials for consumer-oriented and industrial markets and for non-residential construction, environmental remediation, and infrastructure projects. This segment is the Company's largest and most diverse business segment with extensive technical, sales and commercial capabilities. The Specialty Minerals segment produces and sells the synthetic mineral product precipitated calcium carbonate (“PCC”) and processed mineral product quicklime (“lime”), and mines mineral ores then processes and sells natural mineral products, primarily limestone and talc. This segment is a leading supplier globally of PCC products. This segment’s products are used principally in the paper, building materials, paint and coatings, glass, ceramic, polymer, food, automotive and pharmaceutical industries. The Refractories segment produces and markets monolithic and shaped refractory materials and specialty products, services and application and measurement equipment, and calcium metal and metallurgical wire products. Refractories segment products are primarily used in high-temperature applications in the steel, non-ferrous metal and glass industries. 2021 Performance at a Glance 2021 was a strong year for the Company as demonstrated with record sales and earnings as our business recovered from 2020 COVID demand declines. We accomplished this through a combination of operational execution and a focused commitment on advancing our key growth initiatives. We were able to accomplish this while navigating through complex and rapidly changing conditions during the year. We operated in an environment with sharply rising costs, which required frequent 2 | | | | | | | | | Item 1.

| | | Election of Directors

| | |

| | | | | | | | | | | | 01

| | | Joseph C. Breunig

| | | | | | | | | | | | | | | 02

| | | Alison A. Deans

| | | | | | | | | | | | | | | 03

| | | Duane R. Dunham

| | | | | | | | | | | | | | | 04

| | | Franklin L. Feder

| | | | | | | | | | | | | | | Item 2.

| | | Ratification of Appointment of Auditors

| | | | | | | | | | | | | | | Item 3.

| | | Advisory Vote to Approve 2019 Named Executive Officer Compensation

| | | | | | | | | | | | | | | Item 4.

| | | Approval of an Amendment of the 2015 Stock Award and Incentive Plan

| | | | | | | | | | | | | |

Our Company

Minerals Technologies Inc. is a resource- and technology-based company that develops, produces, and markets on a worldwide basis a broad range of specialty mineral, mineral-based and synthetic mineral products and supporting systems and services.

The Company has four reportable segments: Performance Materials, Specialty Minerals, Refractories and Energy Services.

The Performance Materials segment is a leading supplier of bentonite and bentonite-related products and leonardite. This segment also provides products for non-residential construction, environmental and infrastructure projects worldwide, serving customers engaged in a broad range of construction projects.

The Specialty Minerals segment produces and sells the synthetic mineral product precipitated calcium carbonate (“PCC”) and processed mineral product quicklime (“lime”), and mines mineral ores then processes and sells natural mineral products, primarily limestone and talc. This segment’s products are used principally in the paper, building materials, paint and coatings, glass, ceramic, polymer, food, automotive and pharmaceutical industries.

The Refractories segment produces and markets monolithic and shaped refractory materials and specialty products, services and application and measurement equipment, and calcium metal and metallurgical wire products. Refractories segment products are primarily used in high-temperature applications in the steel, non-ferrous metal and glass industries.

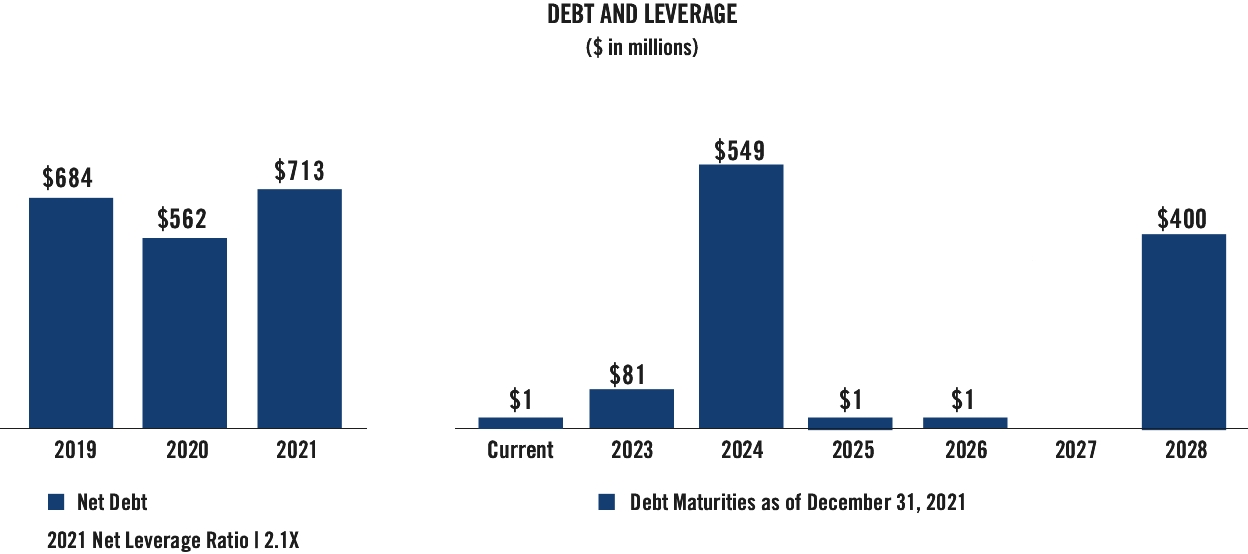

| operational adjustments, process improvements and strong supply change management. We worked closely and transparently with customers managing through these dynamics and were successful in implementing a broad range of pricing actions across our portfolio. We generated strong cash flow and continued to strengthen our balance sheet. The results we achieved in 2021 underscore the power of our operating culture, the resiliency of our global market-leading positions, the value we provide to our customers, and the strength of our financial foundation. The Company’s 2021 sales by segment were as follows: |

TABLE OF CONTENTS

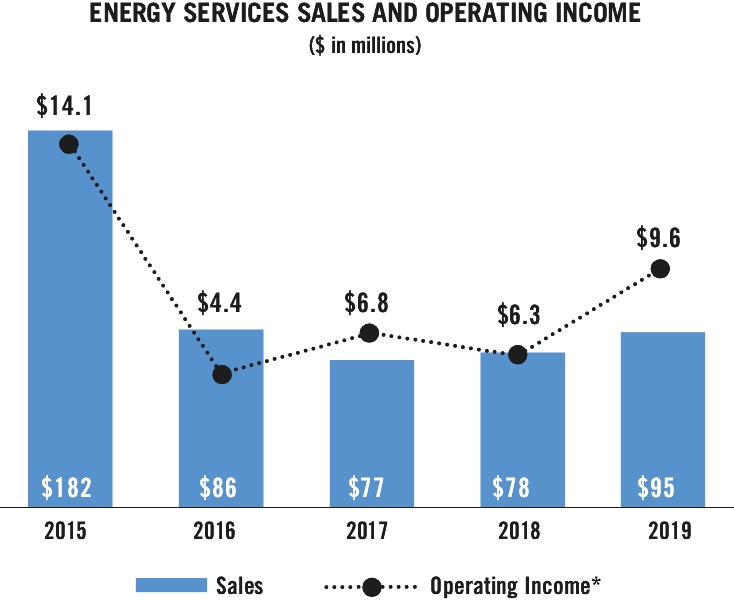

The Energy Services segment provides services to improve the production, costs, compliance, and environmental impact of activities performed in the oil and gas industry. This segment offers a range of services for off-shore filtration and well testing to the worldwide oil and gas industry.

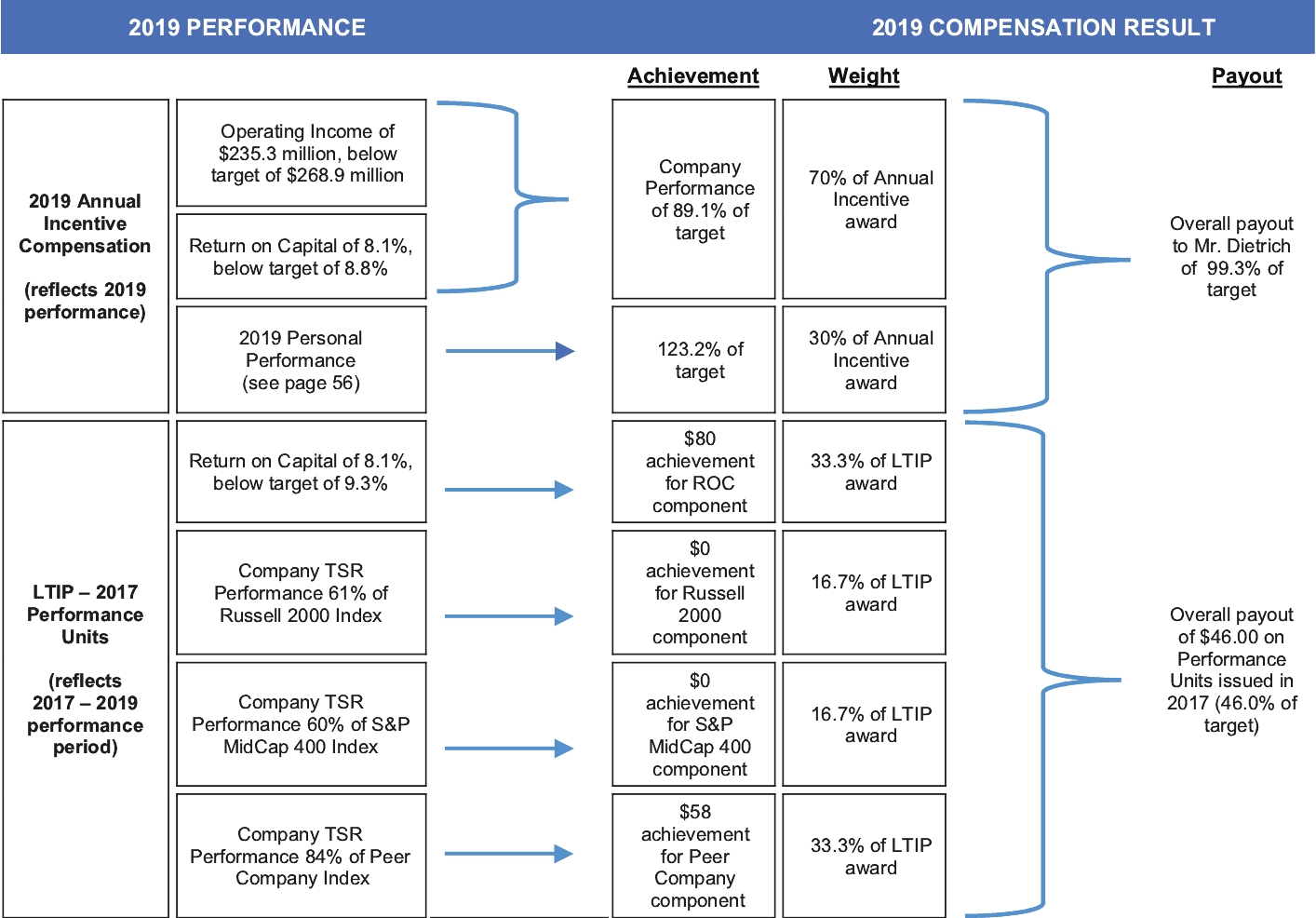

2019 Performance at a Glance

Our performance in 2019 reflects our solid operational and strategic execution against a backdrop of weaker conditions in several markets we serve.

We delivered sales growth across several product lines and geographies, drove increased volumes and supported them through capacity expansions, and capitalized on customer demand for our latest innovative products. Our culture of continuous improvement and focus on aggressive cost control were fundamental in making the necessary changes to adjust our operations to the changing market environment.

The Company’s 2019 sales by segment are as follows:

ADVANCING OUR GROWTH STRATEGY We continue to drive forward our multi-pronged approach to growth through geographic expansion, new product development and acquisitions. We have several key initiatives to advance our growth strategy, and in 2019,2021, we made considerablecontinued to make progress against each of these initiatives. On July 26, 2021, the Company completed the acquisition of Normerica Inc., a leading North American supplier of premium pet care products. As a leader in the pet product industry, Normerica provides premium pet products, both branded and private label to world-class retailers. Its products portfolio consists primarily of clumping sodium and calcium bentonite-based cat litter products which are supplied from a network of strategically located manufacturing facilities in Canada and the United States. We maintain an active pipeline of potential opportunities. In addition to Normerica, we also made a small acquisition of Specialty PCC assets in the Midwest U.S. which strengthens our logistics and manufacturing capabilities. Our consumer-oriented businesses in both Performance Materials and Specialty Minerals remained consistently strong throughout 2021. Much of this performance was driven by our global Pet Care business which grew by 21%, but also through solid increases in personal care, edible oil purification, and other food and pharmaceutical applications. Sales from our consumer-oriented businesses have doubled over the past few years and comprise over 30% of our portfolio, shifting our sales portfolio to be more balanced and stable. We commercialized 63 new value-added products in 2021 as we continued to accelerate the pace of commercialization and drive new revenue prospects. We have increased revenue from new products commercialized over the past five years by 68%. We are the world leader in Greensand Bond Systems for the foundry market. There is a large market opportunity to capitalize on trends in China and India, two of the world’s largest foundry markets, where our customers are responding to demand for higher quality castings. In 2019, we increased penetration into the China foundry market with volume growth of 7% for our tailored blended products. • | We are the world leader in Precipitated Calcium Carbonate (PCC). Our strategy is to expand volumes globally through base filler contracts in underpenetrated regions and by deploying our broad technology portfolio. In 2019, Paper PCC sales in Asia increased 7% supported by our new 125,000 ton satellite in Indonesia. Three more satellites are under construction. In addition, the Company deployed its latest technologies, including FulFill® Plus, Envirofil®PCC and Packaging applications.

|

We are focused on growth in Consumer-Oriented markets through our Household, Personal Care and Specialty Products (HPC) business. In 2019, HPC sales increased 8% driven by the strength of our Pet Care business and sales from our broad portfolio of high-margin specialty applications.

TABLE OF CONTENTS to demand for higher quality castings. In 2021, we further increased penetration into the China foundry market with volume growth of 20% for our tailored blended products. We also continued to demonstrate our value in India, where sales of our blended product were up almost 40% from prior year levels. We are the world leader in Precipitated Calcium Carbonate (PCC). Our strategy has beenis to transition Environmental Productsexpand volumes globally through base filler contracts in underpenetrated regions, such as Asia, and by capitalizing on growing opportunities in adjacent markets, such as packaging and tissue, where we can deploy our latest technologies. In 2021, our PCC business continued to grow geographically with a 22% sales increase in Asia, and we benefited from base geosynthetic clay liners to a higher-value technology portfolio280,000 tons of new capacity that has the capabilities to support more complex landfill remediation and water treatment issues. We have invested in the development of several specialized products to address these larger market opportunities. This strategy is taking hold as sales increased 8% and margins more than doubled over last year. We commercialized 55 new value-added products in 2019, improved the speed of development by 20% and increased revenue from new products commercializedcame online over the past five years by 19%.year. In addition, we signed two new satellite contracts in 2021 totaling around 70,000 tons.

| • | We signed two new satellite contracts in Asia: one for a PCC facility in India, making it our 9th satellite in the country and one with a packaging customer in China. The Company estimates that paper packaging markets are approximately double the size of the printing and writing markets. We offer mineral solutions for filler and coating applications in both the containerboard and cartonboard packaging segments. |

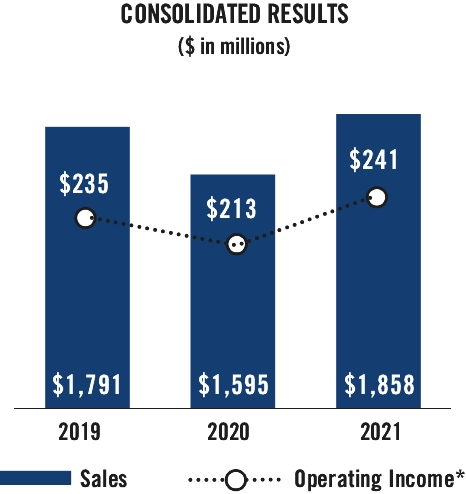

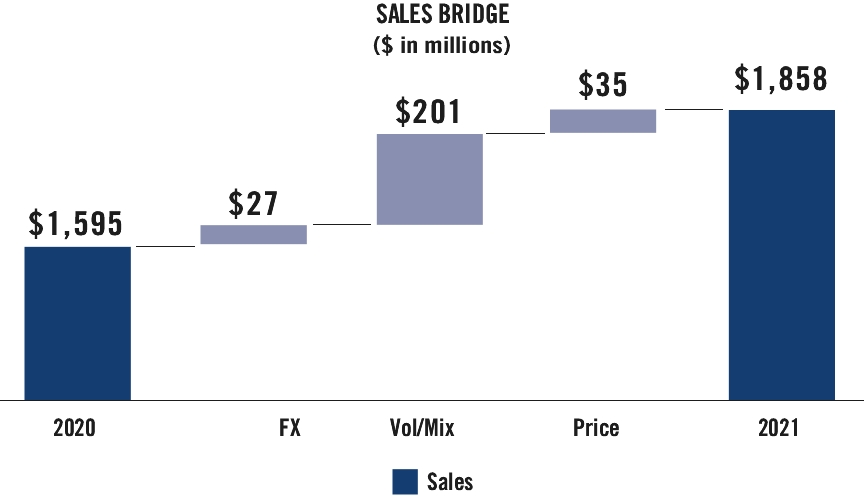

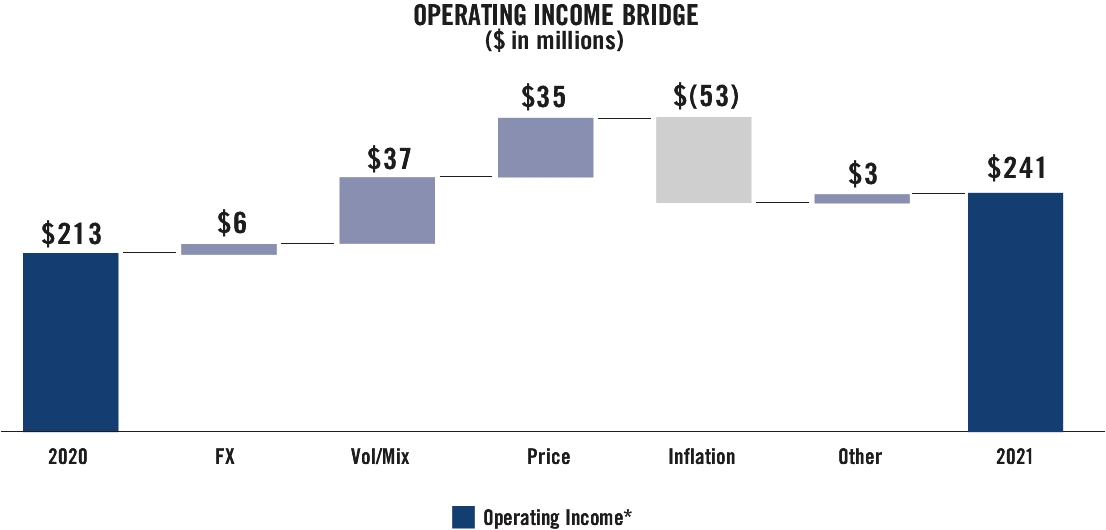

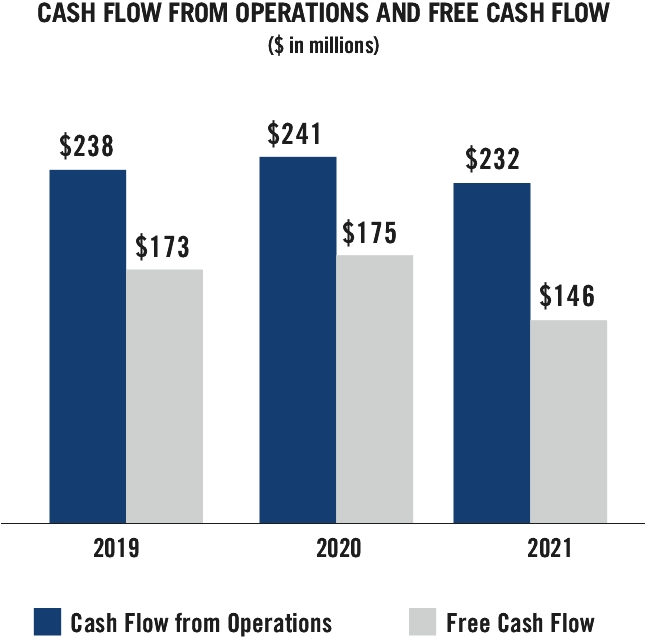

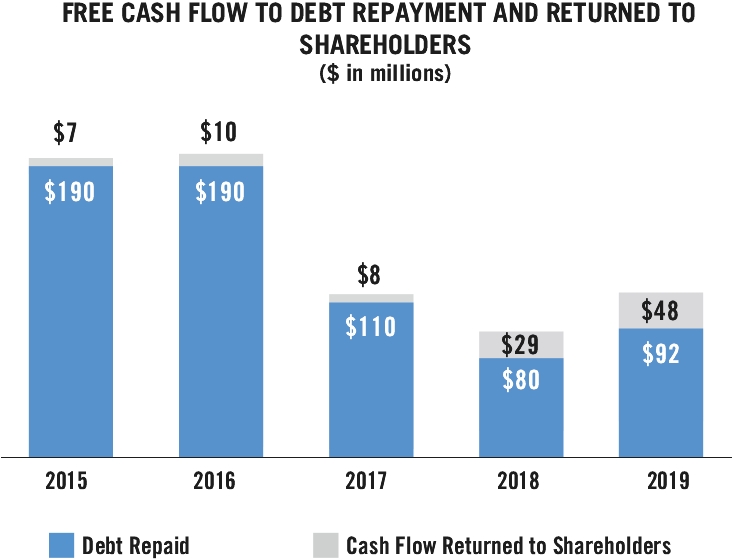

SOLID OPERATING PERFORMANCE IN TOUGHWHILE NAVIGATING A CHALLENGING ENVIRONMENT Operating income, excluding special items, was $241 million and represented 13.0% of sales. The Company delivered a solid performancegenerated strong cash flow from operations for the year at $232 million. Cash flows provided from operations in a challenging environment.2021 were principally used to fund acquisitions and capital expenditures, repay debt, repurchase shares and pay the Company’s dividends to common shareholders. Free cash flow was $146 million. We took decisive actions to align our cost structure to market changes as volume and product mix impacted margins.

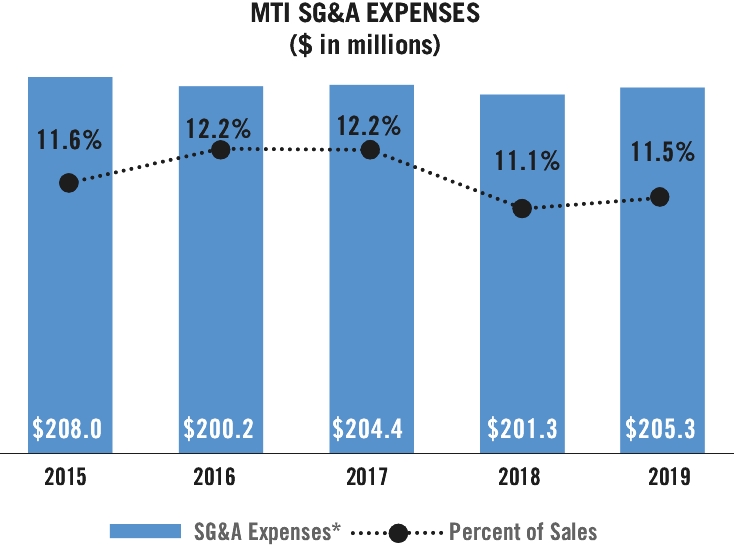

Throughout the year, we also drove productivity improvements, tightly managed our expenses, and continued to drive pricing actions to offset inflationary cost pressures. Operating income, excluding special items, was $235.3 million and represented 13.1% of sales.

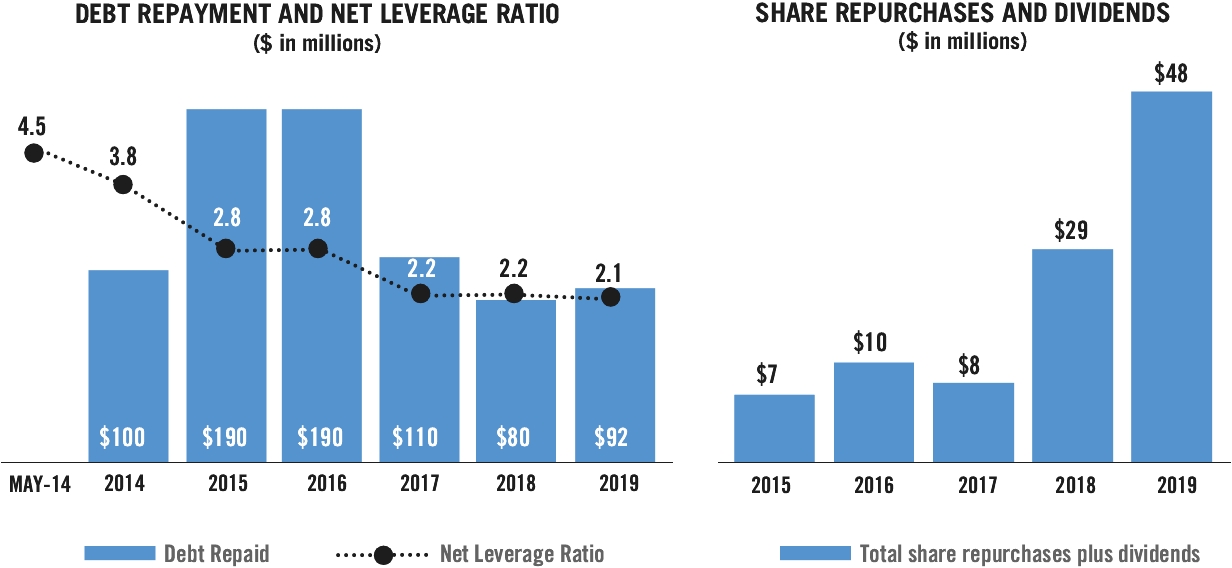

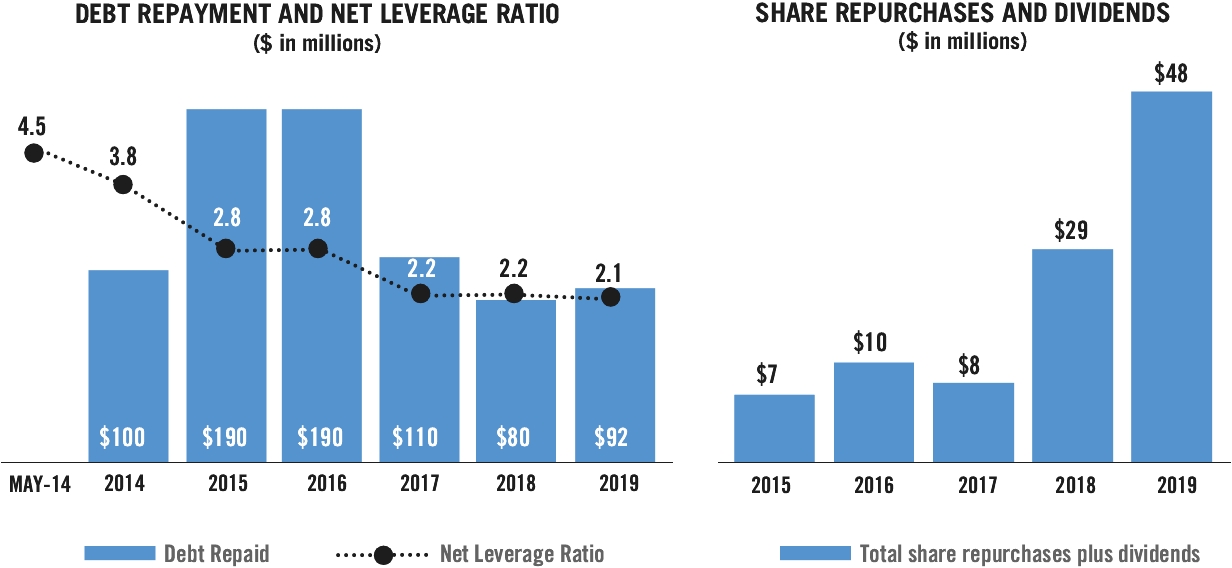

The Company had very strong cash flow from operations for the year at $238 million, an increase of 17%. Cash flows provided from operations in 2019 were principally used for repayment of debt, to fund capital expenditures, repurchase shares and pay the Company’s dividends to common shareholders. Free cash flow increased 36% to $173 million.

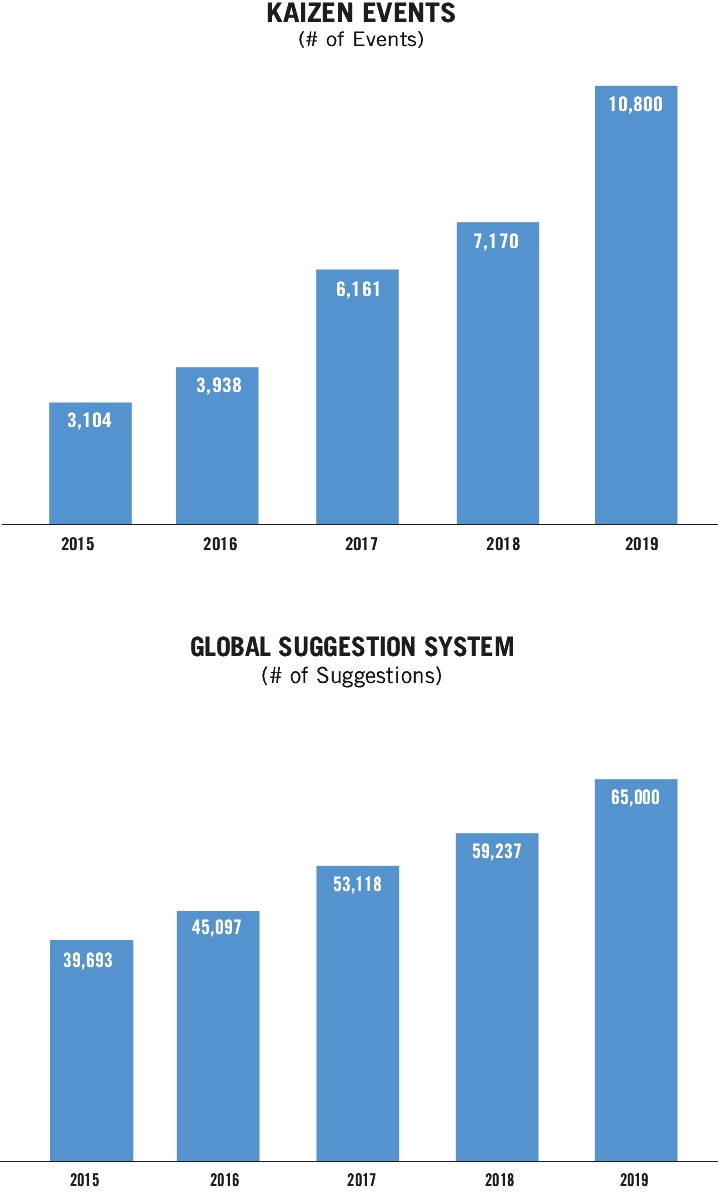

We repurchased approximately 762,0001,001,000 shares for $41$75 million in the year. Throughout the year, we continued to strengthen our balance sheet and maintain flexibility. We repaid $92 million of debt in 2019. Our nethave kept our leverage ratio at the endnear our target levels of 2019 was 2.1.2.0 times EBITDA. SAFETY, OPERATIONAL EXCELLENCE AND SAFETYSUSTAINABILITY Continued successThe COVID-19 pandemic continues to impact lives and businesses around the world. Protecting the health and safety of our employees is one of our core values. Since the onset of the pandemic, we put in place a robust series of protocols to protect our employees while ensuring the safe and efficient operations of our facilities, especially our frontline workers who continue to move and make our products during this critical time. We have remained focused on the health and safety of our employees by implementing Operational Excellencenew safety protocols in our facilities, enhanced screening at all entry points to our facilities, providing personal protective equipment and Lean principles, withhygiene supplies, adhering to social distancing guidelines, recommended remote work, restricting travel and providing paid time off for our employees having held over 10,800 Kaizen events (highly focused workshops) and generating over 65,000 ideas,in quarantine as the result of which 73% were implemented.

Productivity improved 3 percent despite lower volumes, which resulted in savings of approximately $1.5 million.a COVID infection and/or exposure. Employees are continuing to work from home when deemed necessary.

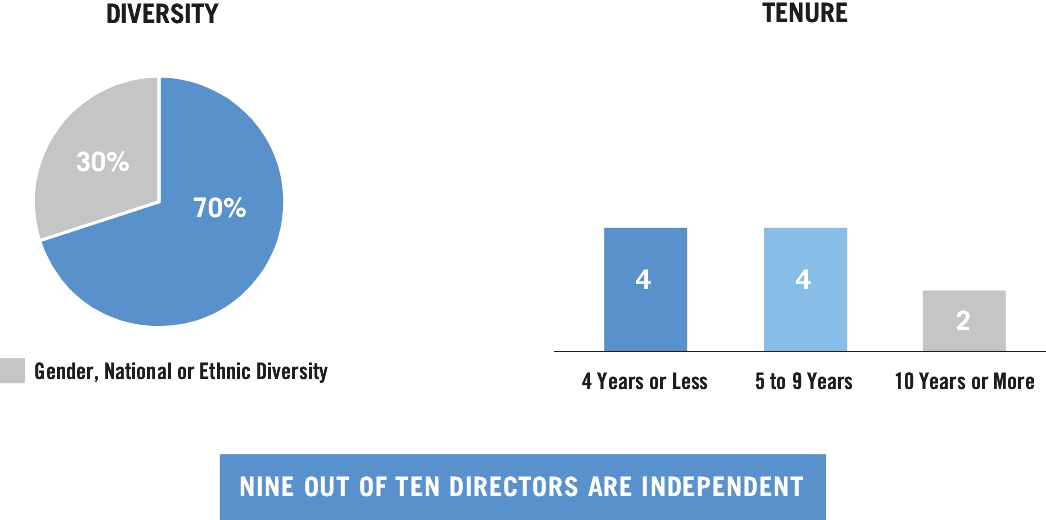

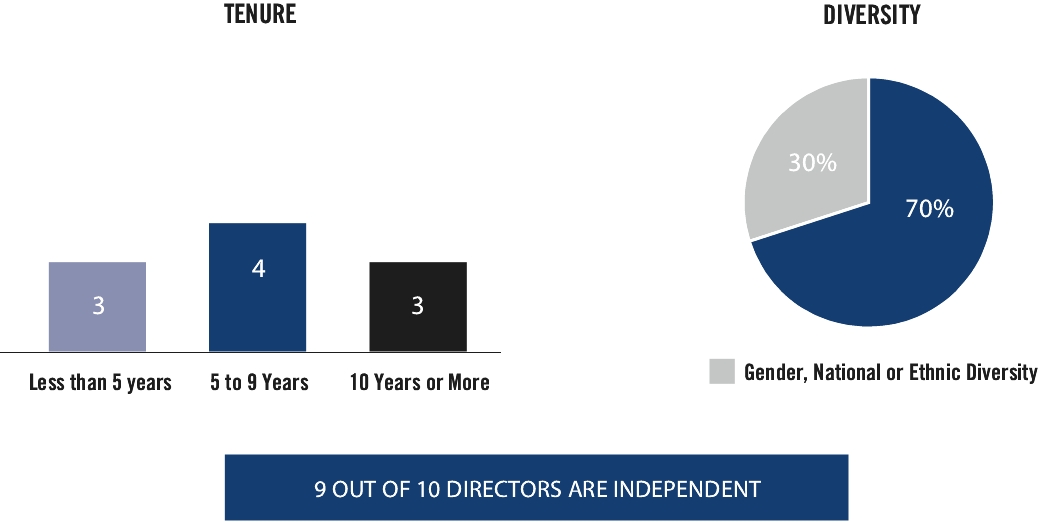

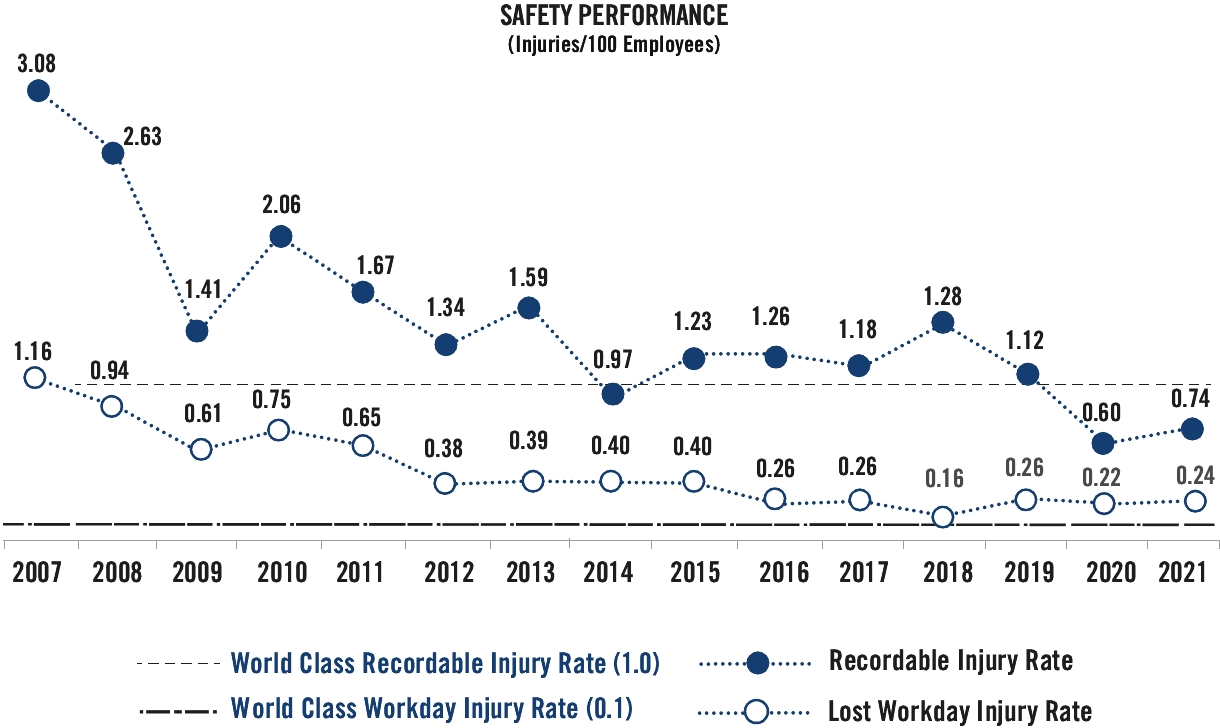

We continued to drive our safety performance toward world class levels and strive for our target of zero injuries. In 2019,2021, our lost workday injury rate was 1.120.24 and our recordable injury rate was 0.26.0.74. Continued success implementing Operational Excellence and Lean principles, with employees having held over 8,000 Kaizen events (highly focused workshops) and received over 65,000 suggestions from our employees, of which 73% were implemented. Productivity improved 5.7 percent which resulted in savings of approximately $4.6 million. In 2021, we made substantial progress to closely align our sustainability practices with our business strategy and goals. We enhanced the reporting and verification of fuel, emissions, water, and waste metrics. We expanded our internal data management system and increased the number of topics we disclose as we take steps to drive transparency and provide more ways to measure progress. New disclosure areas include: total energy consumed, including total direct and indirect energy; percent of electricity consumed purchased from the grid, as well as fuel sources to generate that electricity in several of our major countries; hazardous waste generation; actions to manage and reduce our small tailings and settling TABLE OF CONTENTS ponds; and locations we source water from and discharge water to. We continued reporting to Global Reporting Initiative (GRI) standards and additionally initiated reporting to Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) recommendations. Board of Directors Overview Our Directors exhibit an effective mix of skills, experience and diversity. As part of the Board’s ongoing commitment to maintaining diverse viewpoints and a broad range of skills and experiences, the Board continues to refresh itself to infuse unique ideas and fresh perspectives into the boardroom, most recently welcoming Alison A. Deans, as a new director in 2019.boardroom. | | Name | | Age | | Director

Since | | Professional Background | | Gender,

National or Ethnic

Diversity | | Independent | | Audit

Committee | | Compensation

Committee | | Corporate

Governance

and

Nominating

Committee | | Number of Other U.S.

Public

Boards | | Name | | Age | | Director

Since | | Professional Background | | Gender,

National

or Ethnic

Diversity | | Independent | | Audit

Committee | | Compensation

Committee | | Corporate

Governance

and

Nominating

Committee | | Number

of Other

U.S.

Public

Boards | | | | Joseph C. Breunig | | 58 | | 2014 | | Chief Operating Officer, OrthoLite LLC | | | | ✔ | | | | | | | | 0 | | Joseph C. Breunig | | 60 | | 2014 | | Chief Operating Officer, OrthoLite LLC | | | | ✔ | | | | | | | | 0 | | | | John J. Carmola | | 64 | | 2013 | | Former Segment President, Goodrich Corporation | | | | ✔ | | | | | | | | 0 | | John J. Carmola | | 66 | | 2013 | | Former Segment President, Goodrich Corporation | | | | ✔ | | | | | | | | 0 | | | | Robert L. Clark | | 56 | | 2010 | | Provost and Senior Vice President for Research, University of Rochester | | | | ✔ | | | | | | | | 0 | | Robert L. Clark* | | 58 | | 2010 | | Former Provost and Senior Vice President for Research, University of Rochester | | | | ✔ | | | | | | | | 0 | | | | Alison A. Deans | | 58 | | 2019 | | Independent consultant and former Chief Investment Officer at CRT | | ✔ | | ✔ | | | | | | | | 0 | | Alison A. Deans | | 60 | | 2019 | | Independent consultant and former Chief Investment Officer at CRT | | ✔ | | ✔ | | | | | | | | 0 | | | | Douglas T. Dietrich | | 51 | | 2016 | | Chief Executive Officer, Minerals Technologies | | | | | | | | | | | | 0 | | Douglas T. Dietrich | | 53 | | 2016 | | Chairman of the Board and Chief Executive

Officer, Minerals Technologies | | | | | | | | | | | | 0 | | | | Duane R. Dunham* | | 78 | | 2002 | | Former President and Chief Operating Officer, Bethlehem Steel Corporation | | | | ✔ | | | | | | | | 0 | | Duane R. Dunham | | 80 | | 2002 | | Former President and Chief Operating Officer, Bethlehem Steel Corporation | | | | ✔ | | | | | | | | 0 | | | | Franklin L. Feder | | 69 | | 2017 | | Former Regional Chief Executive Officer for Latin America & the Caribbean, Alcoa | | ✔ | | ✔ | | | | | | | | 2 | | Franklin L. Feder | | 71 | | 2017 | | Former Regional Chief Executive Officer for Latin America & the Caribbean, Alcoa | | ✔ | | ✔ | | | | | | | | 1 | | | | Carolyn K. Pittman | | 56 | | 2017 | | Senior Vice President and Chief Accounting Officer of Maxar Technologies | | ✔ | | ✔ | | | | | | | | 0 | | Carolyn K. Pittman | | 58 | | 2017 | | Senior Vice President and Chief Accounting Officer, Maxar Technologies | | ✔ | | ✔ | | | | | | | | 0 | | | | Marc E. Robinson | | 59 | | 2012 | | Senior Vice President, Enterprise Strategy, CVS Health and Aetna | | | | ✔ | | | | | | | | 0 | | Marc E. Robinson | | 61 | | 2012 | | Former Global President, Pfizer Consumer Healthcare | | | | ✔ | | | | | | | | 0 | | | | Donald C. Winter | | 71 | | 2014 | | Professor of Engineering Practice, University of Michigan; Former 74th Secretary of the Navy | | | | ✔ | | | | | | | | 0 | | Donald C. Winter | | 73 | | 2014 | | Independent Consultant and Chair of the National Academy of Engineering | | | | ✔ | | | | | | | | 0 | |

* Lead Independent Director | | | Chairman of the Board | | | | | | Committee

Chairman | | | | | | Member |

TABLE OF CONTENTS Corporate Governance Practices ✔

| Majority Voting in Director Elections |

✔

| Nine of Ten Directors are Independent |

✔

| Lead Independent Chairman of the BoardDirector |

| Independent Audit, Compensation and Corporate Governance and Nominating Committees

|

Governance and Nominating Committees | Commitment to Board Refreshment (eight new directors since the beginning of 2012) |

✔

| Qualified and Diverse Board |

✔

| Active Shareholder Engagement |

✔

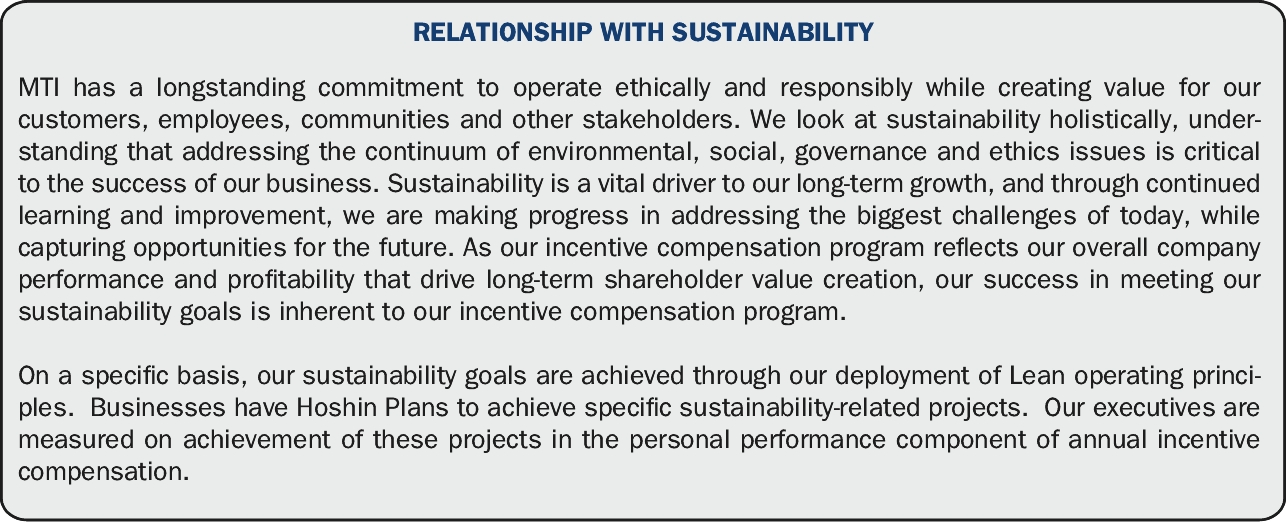

| Commitment to Sustainability |

Executive Compensation Practices ✔

| Link Long-Term Compensation to Stock Performance |

✔

| ExpectTargets Aligned with High Performance |

✔

| Double Trigger for Vesting on Change in Control |

| Stringent Stock Ownership Requirements for Directors and Executive Officers |

| Retention Period on Exercised Stock Options and Vested DRSUs (executives must hold at least 50% of after-tax value for at least five years) |

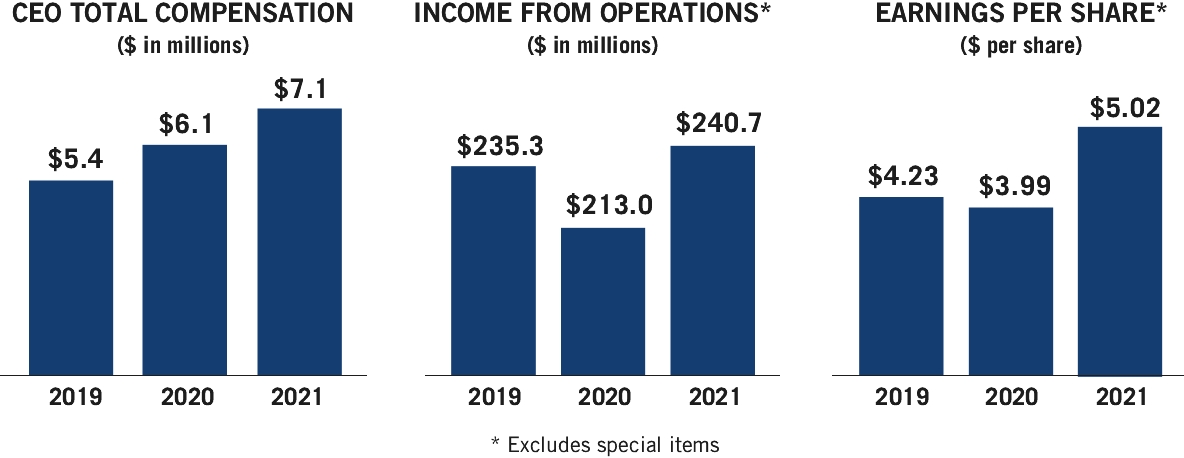

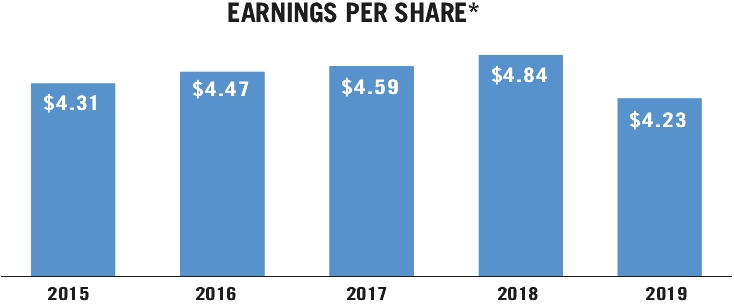

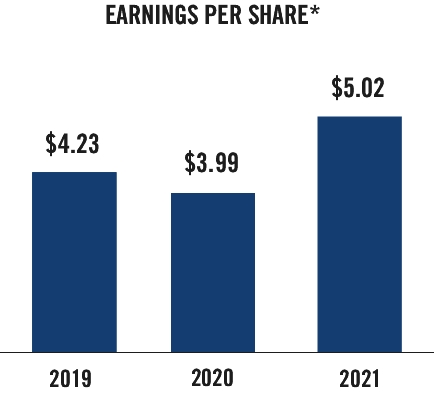

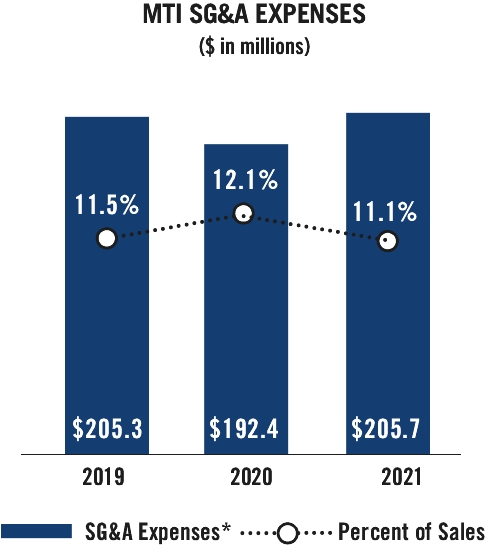

Shareholder Engagement We continued our shareholder outreach program in 20192021 – 2020,2022, including contacting our top 60 shareholders, who we believe at the time collectively held approximately 85%90% of our stock. We solicited our shareholders’ views on whether they considered the disclosure in our proxy statement sufficient and understandable, whether they had any concerns with our executive compensation program, especially our program’s design and the linkage between pay and performance, whether there were any other ways we could enhance our corporate governance structure to be more effective in driving shareholder value, and if they found useful our disclosure regarding our environmental, social and other initiatives focused on the safety of our employees, environmental stewardship, social responsibility and profitable growth, as detailed in our latest Corporate Responsibility and Sustainability Report. The shareholders that engaged with us responded positively with respect to our 20192021 disclosure, executive compensation program, corporate governance and sustainability reporting. As a result of our shareholder engagement efforts, we have taken a number of corporate governance actions in recent years, including implementing and then revising a proxy access by-law, implementing majority voting, and revising our disclosure regarding our Board practices. We have also taken note of our shareholders’ increasing interest in sustainability initiatives,initiatives. In 2021, we published our 13th annual Corporate Responsibility and in 2019 we conducted a comprehensive assessment of the sustainability elements most important toSustainability Report, which details several highlights across our business and communities, which lead to the establishment of target reductions in six environmental focus areas, including greenhouse gas emissions, by 2025.spotlights employee-led efforts and discusses the progress to achieve our 2025 environmental reduction targets. Consideration of Results of 20192021 Shareholder Advisory Vote At our 20192021 Annual Meeting, our shareholders approved the 20182020 compensation of our named executive officers with 97%93.3% of the shares voting on the matter at the meeting voting in favor. We believe that the significant margin of approval of our 20192021 “Say-on-Pay” proposal resulted in large measure from our shareholder engagement effort. As a result of the vast majority of shares favoring our “Say-on-Pay” proposal at our 20192021 Annual Meeting, and the positive feedback we received during our 20192021 – 20202022 shareholder outreach program, we have substantially maintained our executive compensation policies. The Compensation Committee will continue to consider the views of our shareholders in connection with our executive compensation program and make improvements based upon evolving best practices, market compensation information and changing regulatory requirements. TABLE OF CONTENTS Executive Compensation Highlights The Company consistently delivers significant returns to its shareholders. In 2019,2021, we recorded earnings per share of $4.23$5.02 and we generated strong cash flowincome from operations of $238 million.$241 million, each excluding special items. We believe these are key metrics of Company performance that correlate to shareholder value. The Compensation Committee did not modify the terms of outstanding compensation awards or otherwise modify its compensation program or practices due to factors related to the COVID-19 pandemic, including indirect impacts related to the pandemic such as logistics challenges, labor availability challenges, and inflationary cost pressures. The following illustrates the compensation of our Chief Executive Officer, Douglas T. Dietrich, over the past three years. The increase reflects the Company’s performance over the period as well as the Committee’s determination that target compensation should meet a market-based, competitive benchmark. For reference, we also illustrate the Company’s operating income and earnings per share and cash flow from operations over the past three years. * Excludes special items

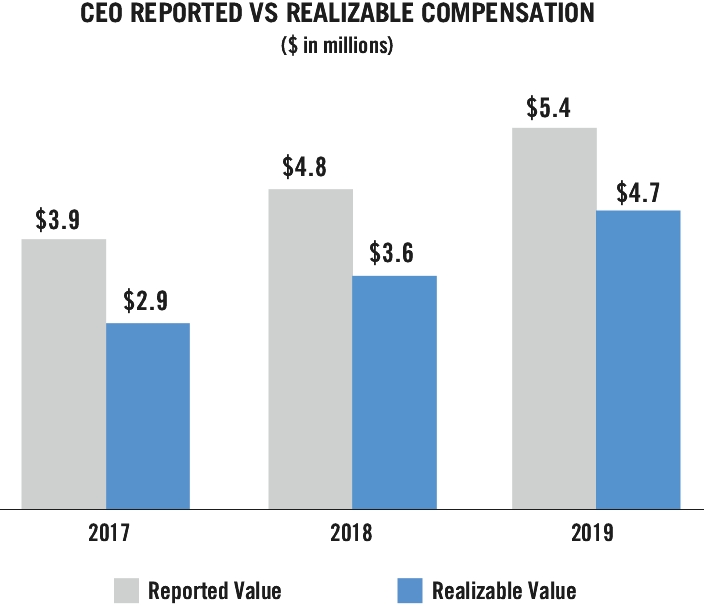

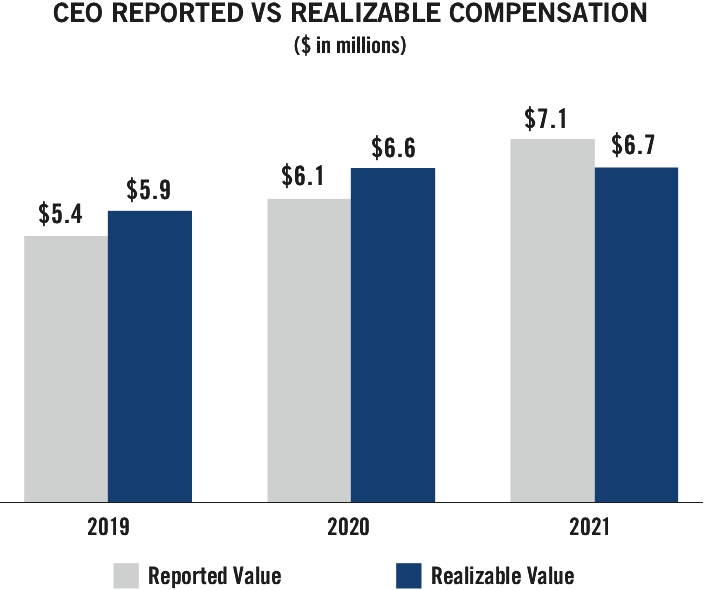

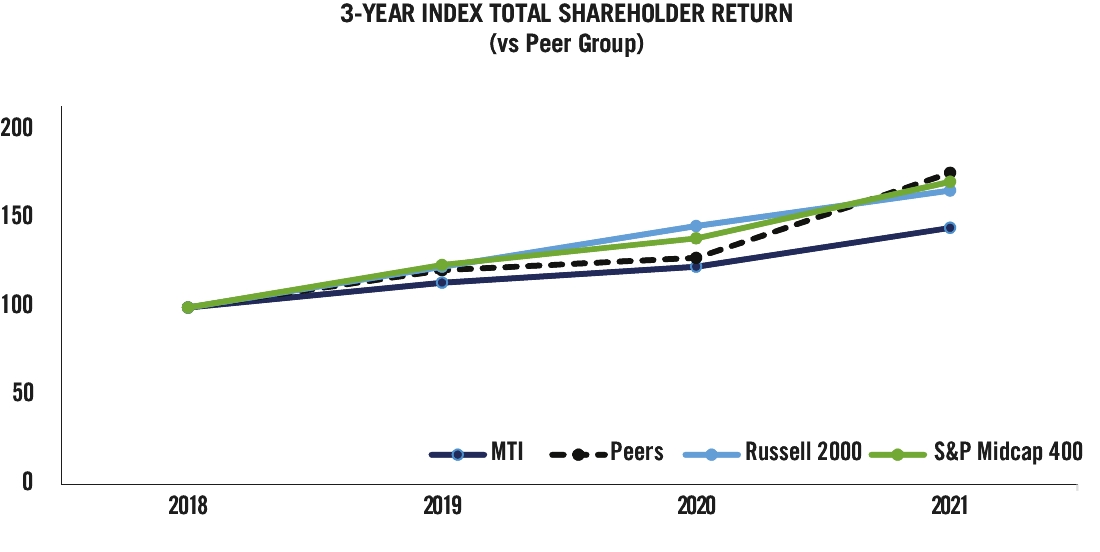

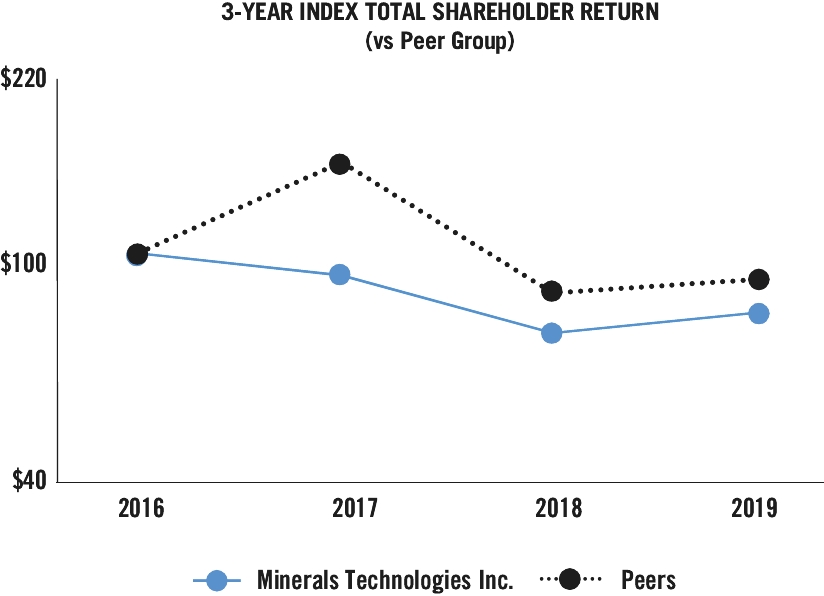

Because the majority of our long-term incentive compensation consists of equity-based awards, the price of our stock directly affects the compensation realizable by our executives. The following is a comparison between the total realizable compensation for Mr. Dietrich for the years 2017–2019 – 2021, determined as of December 31, 2019,2021, and the total compensation we reported in the Summary Compensation Table for that time frame, which uses values for equity awards as of the date of grant. The Company’s stock appreciated in value 18% from December 31, 2020 to December 31, 2021 which substantially increased the realizable compensation value for outstanding prior-year equity awards. TABLE OF CONTENTS MINERALS TECHNOLOGIES INC. 622 THIRD AVENUE, 38th Floor

NEW YORK, NEW YORK 10017-6707 March 31, 2020April 1, 2022

PROXY STATEMENT This proxy statement (“Proxy Statement”) contains information related to the annual meeting of shareholders (“Annual Meeting”) of the Company, to be held at 9:00 a.m. , Eastern Time, on Wednesday, May 13, 2020,18, 2022, virtually, at 1 Highland Avenue, Conference Center, Bethlehem, Pennsylvania 18017.*www.virtualshareholdermeeting.com/MTX2022.It is anticipated that this Proxy Statement, the accompanying Proxy and the Company’s 20192021 Annual Report will first be available to shareholders on or about April 1, 20202022 on the website www.proxyvote.com and, if requested, a paper copy of this Proxy Statement, the accompanying Proxy and the Company’s 20192021 Annual Report will be mailed to the Company’s shareholders. A Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement, Proxy and the Company’s 20192021 Annual Report and vote through the Internet, or by telephone, will be mailed to our shareholders on the same date as this Proxy Statement, the accompanying Proxy and the Company’s 20192021 Annual Report is first available to shareholders. *

| Please see the Meeting Notice on page 1 regarding potential changes to the Annual Meeting location and related matters. |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING 1. Why am I being sent these materials?

The Company has made these materials available to you on the internet, or, upon request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for use at the Annual Meeting. If a quorum does not attend or is not represented by proxy, the meeting will have to be adjourned and rescheduled. 2. Who is asking for my proxy?

The Board of Directors asks you to submit a proxy for your shares so that even if you do not attend the meeting, your shares will be counted as present at the meeting and voted as you direct. 3. What is the agenda for the Annual Meeting?

At the Annual Meeting, shareholders will vote on fourthree items: (i) the election of Joseph C. Breunig, Alison A. Deans, Duane R. DunhamDouglas T. Dietrich and Franklin L. FederCarolyn K. Pittman as members of the Board of Directors, (ii) the ratification of the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm, and (iii) an advisory vote to approve 20192021 executive compensation, and (iv) a proposal to approve an amendment of the 2015 Stock Award and Incentive Plan to increase the number of shares reserved and available for awards thereunder.compensation. Also, management will make a brief presentation about the business of the Company, and representatives of KPMG will make themselves available to respond to any questions from the floor. The Board does not know of any other business that will be presented at the Annual Meeting. The form of proxy gives the proxies discretionary authority with respect to any other matters that come before the Annual Meeting and, if such matters arise, the individuals named in the proxy will vote according to their best judgment. TABLE OF CONTENTS QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

4. How does the Board of Directors recommend I vote?The Board unanimously recommends that you vote for the nominee for directors, Joseph C. Breunig, Alison A. Deans, Duane R. Dunham and Franklin L. Feder, for ratification of the appointment of KPMG to continue as our auditors, for the advisory vote approving 2019 executive compensation and for approval of the amendment to the 2015 Stock Award and Incentive Plan.

5. Who can attend the Annual Meeting?Any shareholder of the Company, employees, and other invitees may attend the Annual Meeting.

6. Who can vote at the Annual Meeting?

Anyone who owned shares of our common stock at the close of business on March 17, 202022, 2022 (the “Record Date”) may vote those shares at the Annual Meeting. Each share is entitled to one vote. 5. How does the Board of Directors recommend I vote?

The Board unanimously recommends that you vote for the nominees for directors, Douglas T. Dietrich and Carolyn K. Pittman, for ratification of the appointment of KPMG to continue as our auditors, and for the advisory vote approving 2021 executive compensation. 6. How can I attend the Annual Meeting?

In light of the public health impact of the ongoing COVID-19 pandemic and to protect the health and well-being of the Company’s shareholders, employees, directors and other participants, once again this year, the Annual Meeting will be held in a virtual meeting format via live webcast. There will be no in-person meeting. You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/MTX2022. The meeting webcast will begin promptly at 9:00 a.m., Eastern Time. If you are a shareholder of record as of the close of business on March 22, 2022, you may log in to the meeting platform beginning at 8:45 a.m., Eastern Time, by entering the 16-digit control number found on your proxy card or voting instruction form. You will have the opportunity to vote your shares, submit questions, and view our list of shareholders entitled to vote at the Annual Meeting using the instructions provided on the meeting website. Those without a control number may attend the Annual Meeting as guests by logging in to the same virtual meeting platform and following the instructions on the website for guest access. Guests will not be able to vote or ask questions. 7. How will management respond to questions during the virtual meeting?

Our Board considers the appropriate format of the meeting on an annual basis. We recognize that, while our Annual Meeting is just one of the forums where we engage with shareholders, it is an important one. The virtual meeting format allows our shareholders to engage with us no matter where they live and is accessible and available on any internet-connected device. This provides the opportunity for participation by a broader group of shareholders than just those who can travel to an in-person meeting, particularly in light of the COVID-19 pandemic. We intend that the virtual meeting format will provide shareholders a level of participation and transparency at least as great as the traditional in-person meeting format. Shareholders who wish to submit a question to the Company may do so during the meeting at www.virtualshareholdermeeting.com/MTX2022. Management will respond to questions from shareholders in the same way as it would if the Company held an in-person meeting, answering as many questions as possible in the time allotted for the meeting, without discrimination, as long as the questions are submitted in accordance with the meeting rules of conduct (for example, the Company does not intend to answer questions that are irrelevant to the business of the Company or to the business of the Annual Meeting). If there are appropriate questions that we cannot answer during the meeting, we will post the questions and answers thereto in the Investor Relations area of our website, www.mineralstech.com. 8. What constitutes a quorum for the meeting?

According to the by-laws of the Company, a quorum for all meetings of shareholders consists of the holders of a majority of the shares of common stock issued and outstanding and entitled to vote, present in person or by proxy. On the Record Date there were 34,222,538 shares of 33,008,687 common stock issued and outstanding, so at least 17,111,27016,504,344 shares must be represented at the meeting for business to be conducted. Shares of common stock represented by a properly signed and returned proxy are treated as present at the Annual Meeting for purposes of determining a quorum, whether the proxy is marked as casting a vote or abstaining. Shares represented by “broker non-votes” are also treated as present for purposes of determining a quorum. Broker non-votes are shares held in record name by brokers or nominees, as to which the broker or nominee (i) has not received instructions from the beneficial owner or person entitled to vote, (ii) does not have discretionary voting power under applicable New York Stock Exchange rules or the document under which it serves as broker or nominee, and (iii) has indicated on the proxy card, or otherwise notified us, that it does not have authority to vote the shares on the matter. TABLE OF CONTENTS QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

If a quorum does not attend or is not represented, the Annual Meeting will have to be postponed. 8.9. How many votes are required for each question to pass?

Directors are elected by the vote of the majority of the votes cast in uncontested elections. All other questions are determined by a majority of the votes cast on the question, except as otherwise provided by law or by the Certificate of Incorporation. 9.10. What is the effect of abstentions and broker non-votes?

Under New York Stock Exchange Rules, the proposal to ratify the appointment of independent auditors is considered a “discretionary” item. This means that brokerage firms may vote in their discretion on this matter on behalf of clients who have not furnished voting instructions at least 10 days before the date of the meeting. In contrast, the election of directors and the advisory vote to approve 20192021 executive compensation and the vote to approve the amendment of the 2015 Stock Award and Incentive Plan are “non-discretionary” items. This means brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them. These so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval and will have no effect on the outcome of the election of directors or the advisory vote to approve 20192021 executive compensation, or the approval of the amendment of the 2015 Stock Award and Incentive Plan.compensation. Similarly, abstentions will be included in the calculation of the number of votes considered to be present for purposes of determining a quorum, but will have no effect on the outcome of the election of directors, the ratification of the appointment of our independent auditors,auditor or the advisory vote to approve 20192021 named executive officer compensation, or the approval of the amendment of the 2015 Stock Award and Incentive Plan.compensation. 10.11. Who will count the votes?

A representative from Broadridge Financial Solutions, Inc. will serve as inspector of election. TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

|

11.12. Who are the Company’s largest shareholders?

BlackRock Inc. owns 11.9%11.3%; Vanguard Group Inc. owns 9.5%9.6%; Dimensional Fund Advisors LP owns 6.0%; T. Rowe Price Associates, Inc.Inc, owners 5.3%; Franklin Mutual Advisers, LLC owns 7.7%5.3% and Dimensional Fund Advisors LPMacquarie Group Limited owns 6.1%5.1%. The percentages of ownership were calculated based on our outstanding shares of 34,473,83533,163,833 as of January 31, 2020.2022. No other person owned of record, or, to our knowledge, owned beneficially, more than 5% of the Company’s common stock. 12.13. How can I cast my vote?

You can vote by proxy over the internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail pursuant to the instructions provided on the proxy card. If you hold shares beneficially in street name, you may also vote by proxy over the internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail by following the voting instruction card provided to you by your broker, bank, trustee or nominee. If you are an employee who participates in the Company’s Savings and Investment Plan (the Company’s 401(k) plan), to vote your shares in the Plan you must provide the trustee of the Plan with your voting instructions in advance of the meeting. You may do so by proxy over the internet by following the instructions provided in the Notice, or, if you requested to receive printed proxy materials, you can also vote by mail by following the voting instructions provided in the proxy card. You cannot vote your shares in person atvia the virtual Annual Meeting;Meeting platform; the trustee is the only one who can vote your shares at the Annual Meeting. The trustee will vote your shares as you instruct. If the trustee does not receive your instructions, your shares generally will be voted by the trustee in proportion to the way the other Plan participants voted. To allow sufficient time for voting by the trustee, your voting instructions must be received by 11:59 p.m., Eastern Daylight Time, (EDT) on May 11, 2020.15, 2022. 13.14. What if I submit a proxy but don’t mark it to show my preferences?

If you return a properly signed proxy without marking it, it will be voted in accordance with the Board of Directors’ recommendations on all proposals. TABLE OF CONTENTS QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING |

15. What if I submit a proxy and then change my mind?

If you submit a proxy, you can revoke it at any time before it is voted by submitting a written revocation or a new proxy, or by voting in person at the Annual Meeting. However, if you have shares held through a brokerage firm, bank or other custodian, you can revoke an earlier proxy only by following the custodian’s procedures. Employee Savings and Investment Plan participants can notify the Plan trustee in writing that prior voting instructions are revoked or are changed. 15.16. Who is paying for this solicitation of proxies?

The Company pays the cost of this solicitation. In addition to soliciting proxies through the mail using this Proxy Statement, we may solicit proxies by telephone, facsimile, electronic mail and personal contact. These solicitations will be made by our regular employees without additional compensation. We have also engaged Morrow Sodali LLC, 470 West Ave.,333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902 to assist in this solicitation of proxies, and we have agreed to pay that firm $5,500$6,000 for its assistance, plus expenses. 16.17. Where can I learn the outcome of the vote?

The Secretary will announce the preliminary voting results at the Annual Meeting, and we will publish the final results in a current report on Form 8-K which will be filed with the Securities and Exchange Commission as soon as practicable after the Annual Meeting. 10 |  |

TABLE OF CONTENTS SHAREHOLDER ENGAGEMENT We engage in an extensive, ongoing shareholder engagement effort that we began in 2012. This consists of discussing corporate governance, compensation and other matters with our shareholders well before the annual meeting, as well as during proxy voting. We also engage with proxy advisory firms that represent the interests of various shareholders. We continued this shareholder outreach program in 20192021 – 2020,2022, including contacting our top 60 shareholders, who we believe at the time collectively held approximately 85%90% of our stock. We solicited our shareholders’ views on whether they considered the disclosure in our proxy statement sufficient and understandable, whether they had any concerns with our executive compensation program, especially our program’s design and the linkage between pay and performance, whether there were any other ways we could enhance our corporate governance structure to be more effective in driving shareholder value, and if they found useful our disclosure regarding our environmental, social and other initiatives focused on the safety of our employees, environmental stewardship, social responsibility and profitable growth, as detailed in our most recent Corporate Responsibility and Sustainability Report. The shareholders that engaged with us responded positively with respect to our 20192021 disclosure, executive compensation program, corporate governance and sustainability reporting. The following is a sampling of the comments we received from our shareholders through this engagement process:

“You’ve done a good job refreshing the Board.”

“I think the company’s focus on employee safety and environmental stewardship is spot on. It is encouraging the company has goals for GHG (absolute reduction), renewable energy, water, air emissions and waste. As the mining and processing of minerals is relatively energy and water intensive, its inclusion of these targets is important.”

“Your sustainability report looks very good and was well written.”

“We don’t see anything concerning from a governance standpoint.”

“We gave you a green light on incentive compensation.”

As a result of our shareholder engagement efforts, we have taken a number of corporate governance actions in recent years, including implementing and then revising a proxy access by-law, implementing majority voting, and revising our disclosure regarding our Board practices. We have also taken note of our shareholders’ increasing interest in sustainability initiatives,initiatives. In 2021, we published our 13th annual Corporate Responsibility and in 2019 we conducted a comprehensive assessment of the sustainability elements most important toSustainability Report, which details several highlights across our business and communities, which lead to the establishment of target reductions in six environmental focus areas, including greenhouse gas emissions, by 2025.spotlights employee-led efforts and discusses the progress to achieve our 2025 environmental reduction targets.  | 11 |

TABLE OF CONTENTS CORPORATE GOVERNANCE Our Board of Directors (the “Board”) oversees the activities of our management in the handling of the business and affairs of our company, reviews and approves fundamental financial and business strategies, assesses major risks facing the Company, and assures that the long-term interests of shareholders are being served. As part of the Board’s oversight responsibility, it monitors developments in the area of corporate governance. The Board has adopted a number of policies with respect to our corporate governance, including the following: (i) a set of guidelines setting forth the operation of our Board and related governance matters, entitled “Corporate Governance Guidelines”; (ii) a code of ethics for the Company’s Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer, entitled “Code of Ethics for Senior Financial Officers”; and (iii) a code of business conduct and ethics for directors, officers and employees of the Company entitled “Summary of Policies on Business Conduct.” The Board annually reviews and amends, as appropriate, our governance policies and procedures. The Corporate Governance Guidelines, the Code of Ethics for Senior Financial Officers and the Summary of Policies on Business Conduct are posted on our website, www.mineralstech.com, under the links entitled “Our Company,” then “Corporate Governance,” and then “Policies and Charters,” and are available in print at no charge to any shareholder who requests them by writing to Secretary, Minerals Technologies Inc., 622 Third Avenue, 38th Floor, New York, New York 10017-6707. Our Board of Directors Our Board is elected by our shareholders to oversee our business and affairs. The Board advises and counsels management regarding the long-term interests of the Company, our shareholders and other stakeholders regarding a broad range of subjects. The Board and its Committees also performs a number of specific functions, such as: Selecting, evaluating performance of, and compensating the Chief Executive Officer, overseeing Chief Executive Officer succession planning, and providing counsel and oversight on the selection, evaluation, development, and compensation of senior management; Reviewing, approving and monitoring fundamental financial and business strategies, including our annual plan and longer-term strategic plans, significant capital expenditures and uses of the Company’s funds, and other major corporate actions; Ensuring processes are in place for maintaining the integrity of the Company, the integrity of its financial statements, the integrity of its compliance with laws, rules, regulations, and ethics, the integrity of its relationships with customers and suppliers, and the integrity of its relationships with other stakeholders; Assessing major risks facing the Company and reviewing options for their management and mitigation; Regularly reviewing the Company’s safety culture and performance, environmental compliance, sustainability practices diversity and sustainability practices;inclusion activities, and social and governance policies; and Regularly evaluating potential strategic alternatives relating to the Company and our business, including possible acquisitions, divestitures and business combinations. Meetings and Attendance The Board met five times in 2019.2021. Each of the directors attended at least 75% of the meetings of the Board and committees on which he or she served in 2019.2021. At each regular meeting of the Board, the independent (non-management) directors have an opportunity to meet in executive session outside the presence of Mr. Dietrich, the Company’s sole non-independent (management) director or any other member of management. Under our Corporate Governance Guidelines, all members of the Board are expected to attend the Annual Meeting of Shareholders. All of the members of the Board attended last year’s Annual Meeting of Shareholders. 12 |  |

TABLE OF CONTENTS Director Independence The Board has adopted the following categorical standards to guide it in determining whether a member of the Board can be considered “independent” for purposes of Section 303A of the Listed Company Manual of the New York Stock Exchange: A director will not be independent if, within the preceding three years: the director was employed by the Company, or an immediate family member of the director was employed by the Company, as an executive officer; the director or an immediate family member of the director received more than $120,000 per year in direct compensation from the Company, other than director and committee fees and pensions or other forms of direct compensation for prior service (provided such compensation is not contingent in any way on continued service); the director was employed by or affiliated with the Company’s independent registered public accounting firm or an immediate family member of the director was employed by or affiliated with the Company’s independent registered public accounting firm in a professional capacity; the director or an immediate family member was employed as an executive officer of another company where any of the Company’s present executives served on that company’s compensation committee; and the director was an executive officer or an employee, or had an immediate family member who was an executive officer, of a company that made payments to, or received payments from, the Company for goods or services in an amount which, in any single fiscal year, exceeded the greater of $1,000,000 or 2% of the other company’s consolidated gross revenues. In the case of each director who qualifies as independent, the Board is aware of no relationships between the director and the Company and its senior management, other than the director’s membership on the Board of the Company and on committees of the Board. As a result of its application of the categorical standards and the absence of other relationships, the Board has affirmatively determined (with each member abstaining from consideration of his or her own independence) that none of the non-employee members of the Board violates the categorical standards or otherwise has a relationship with the Company and, therefore, each is independent. Specifically, the Board has affirmatively determined that Mr. Joseph C. Breunig, Mr. John J. Carmola, Dr. Robert L. Clark, Jr., Ms. Alison A. Deans, Mr. Duane R. Dunham, Mr. Franklin L. Feder, Ms. Carolyn K. Pittman, Mr. Marc E. Robinson, and Dr. Donald C. Winter, comprising all of the non-employee directors, are independent. Board Leadership Structure The Board continuously evaluatesrecognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure. In 2016,structure to ensure both a highly engaged and high-functioning Board and independent oversight of senior management. The Company’s governance documents provide the Board elected Mr. Duane R. Dunham aswith flexibility to select the leadership structure that is most appropriate for the Company and its shareholders at any particular time, given the dynamic and competitive environment in which we operate. At the present time, the Board believes a leadership model with a combined Chairman/CEO position and a Lead Independent Director best supports the creation of long-term, sustainable value for our shareholders. The Board believes that the current Chairman of the Board. Mr. Dunham has been an independent Director of the Company since 2002. Upon his election asBoard and Chief Executive Officer, Mr. Dietrich, waspossesses detailed and in-depth knowledge of the issues, opportunities and challenges facing the Company and its businesses and is thus best positioned to ensure that the Board’s time and attention are focused on the most critical matters facing the Company. The Board also electedbelieves that Mr. Dietrich’s combined role ensures clear accountability and enhances the Company’s ability to communicate its message and strategy clearly and consistently. Further, the Board believes that the strength of the Company’s corporate governance provides for objective, independent Board leadership, including through: the strong, independent oversight function exercised by the Board — which consists entirely of independent directors other than Mr. Dietrich; the independent leadership that will be provided by the Lead Independent Director, who has robust, well-defined responsibilities under a Board-approved charter; the company’s corporate governance principles and policies; and Board and committee processes and procedures that provide substantial independent oversight of Mr. Dietrich’s performance, including regular executive sessions of the independent directors and an annual evaluation of Mr. Dietrich’s performance against predetermined goals. TABLE OF CONTENTS The Board recognizes the benefit of independent leadership with a clearly defined role and set of responsibilities to enhance the effectiveness of the Board’s oversight role. For this reason, the Board adopted a charter for the Company’s Lead Independent Director that provides that, in the event the Chairman of the Board and Chief Executive Officer positions are held by one person, the Company’s independent directors may designate a Lead Independent Director from among the independent directors. The designation of the Lead Independent Director is to be made annually, although with the expectation of the Board that the Lead Independent Director will be re-appointed for multiple, consecutive one-year terms. The Charter provides the position a clear mandate, significant authority, and well-defined responsibilities, including the following: Lead Board meetings when the Chairman is not present; Lead executive sessions of the independent directors; Serve as an ex-officio member of each Committee and regularly attend meetings of the various Committees; Call meetings of the independent directors; Convene the Board to discuss and determine the appropriate succession plan for the Chairman and CEO in the event the Chairman and CEO is unable to perform his regular duties due to illness, death or incapacitating event; Lead the independent directors’ evaluation of the Chairman and CEO’s effectiveness, including assessing his ability to provide leadership and direction to the Board. Allfull Board; Serve as liaison between the independent directors withand the exceptionChairman and CEO; Approve information sent to the Board, including the quality, quantity and timeliness of Mr. Dietrich, are independent. such information; Contribute to the development of, and approve meeting agendas; Facilitate the Board’s approval of the number and frequency of Board meetings and approve meeting schedules to ensure sufficient time for discussion of all agenda items; Authorize the retention of outside advisors and consultants who report directly to the Board; Keep apprised of inquiries from shareholders and involved in correspondence responding to those inquiries, when appropriate; and If requested by shareholders or other stakeholders, ensure that he or she is available, when appropriate, for consultation and direct communication. The Lead Independent Director Charter is available on our website, www.mineralstech.com, under the links entitled “Our Company,” then “Corporate Governance,” and then “Policies and Charters”. In practice, the Board continues to act cooperatively. Mr. Dunham and Mr. Dietrich develop Board agendas in consultation with other Board members, who may request an item be added to the agenda. The Board expects the independent directors towill work collaboratively with Mr. Dietrich to discharge their Board responsibilities, including in determining items to be raised in the executive session meetings of independent directors.responsibilities. The Company believes that this approach effectively encourages full participation by all Board members in relevant matters, while avoiding unnecessary hierarchy. It provides a well-functioning and effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors. The Board believes that additional structure or formalities would not enhance the substantive corporate governance process and could restrict the access of individual Board members to management.

The Board recognizes that there is no single, generally accepted approach to providing Board leadership. While the Corporate Governance Guidelines currently provideit has adopted this leadership structure for the foregoing leadership structure,present, the Board reserves the right to adopt a different policy as circumstances warrant. Board Size and Committees It is the policy of the Company that the number of Directors should not exceed a number that can function efficiently as a body. The Board currently consists of ten members, nine of whom have been affirmatively determined to be independent. Upon Dr. Winter’s retirement in May 2022, the Board size will be nine. The Board currently has the following Committees: Audit, Compensation, and Corporate Governance and Nominating. TABLE OF CONTENTS

Each Committee consists entirely of independent, non-employee directors. The responsibilities of such Committees are more fully discussed below under “Committees of the Board of Directors.” The Corporate Governance and Nominating Committee considers and makes recommendations to the Board concerning the appropriate size and needs of the Board and its Committees. TABLE OF CONTENTS Board Refreshment The Board is committed to effective board succession planning and refreshment as part of the Board’s ongoing commitment to maintaining diverse viewpoints and a broad range of skills and experiences. We have experienced a healthy level of turnover on the Board, with three new directors since the beginning of 2017, and eight new directors since the beginning of 2012. This refreshment process has infused unique ideas and fresh perspectives into the boardroom, and has significantly increased the diversity of our Board. The Board does not endorse arbitrary term limits on directors’ service. However, it is the policy of the Company that each director shall submit his or her resignation from the Board not later than the date of his or her 72nd birthday. The Board will then determine whether to accept such resignation. The Board self-evaluation process is an important determinant for continuing service by current directors. In compliance with this policy, Mr. Dunham submitted his resignation upon reaching age 72. The Board determined not to accept his resignation at such time, and continues to believe that his continuing service is valuable to the Company, as demonstrated by his renomination to the Board at this Annual Meeting of Stockholders. Identification and Evaluation of Directors The Corporate Governance and Nominating Committee is charged with seeking individuals qualified to become directors and recommending candidates for all directorships to the full Board. The Committee considers director candidates to fill new positions created by expansion and vacancies that occur by resignation, by retirement or for any other reason. While the Board has not established any minimum set of qualifications for membership on the Board, candidates are selected for, among other things, their integrity, independence, diversity, range of experience, leadership, the ability to exercise sound judgment, the needs of the Company and the range of talent and experience already represented on the Board. See “Director Qualifications and Diversity Considerations” below for detailed information concerning directors’ qualifications. The Committee considers director candidates suggested by members of the Committee, other directors, senior management and shareholders. The Committee has the authority to use outside search consultants at its discretion. Final approval of a candidate is determined by the full Board. Shareholders wishing to recommend a director candidate to the Committee for its consideration should write to the Committee, in care of Secretary, Minerals Technologies Inc., 622 Third Avenue, 38th Floor, New York, New York 10017-6707. To receive meaningful consideration, a recommendation should include the candidate’s name, biographical data, and a description of his or her qualifications in light of the criteria discussed below. Recommendations by shareholders that are made in accordance with these procedures will receive the same consideration by the Committee as other suggested nominees. Shareholders wishing to nominate a director directly at a meeting of shareholders should follow the procedures set forth in the Company’s by-laws and described under “Shareholder Proposals and Nominations,” below. Director Qualifications and Diversity Considerations Directors are responsible for overseeing the Company’s business and affairs consistent with their fiduciary duty to shareholders. This significant responsibility requires highly-skilled individuals with various qualities, attributes, skills and experiences. The Board and Corporate Governance and Nominating Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field. It is expected that candidates will have an appreciation of the responsibilities of a director of a company whose shares are listed on a national securities exchange. The Board and Committee also take into account the ability of a director to devote the time and effort necessary to fulfill his or her responsibilities to the Company. The Committee considers the need for diversity on the Board as an important factor when identifying and evaluating potential director candidates and believes that the composition of the Board should reflect sensitivity to the need for diversity as to geography, gender, ethnic background, profession, skills and business experience. While the Board does not have a specific written diversity policy, the Company is committed to inclusiveness with respect to diversity of ethnicity and gender. Accordingly, in performing its responsibilities to review director candidates and recommend candidates to the Board for election, the Committee is committed to ensuring that candidates with a diversity of ethnicity and gender are included in each pool of candidates from which Board nominees are chosen. TABLE OF CONTENTS

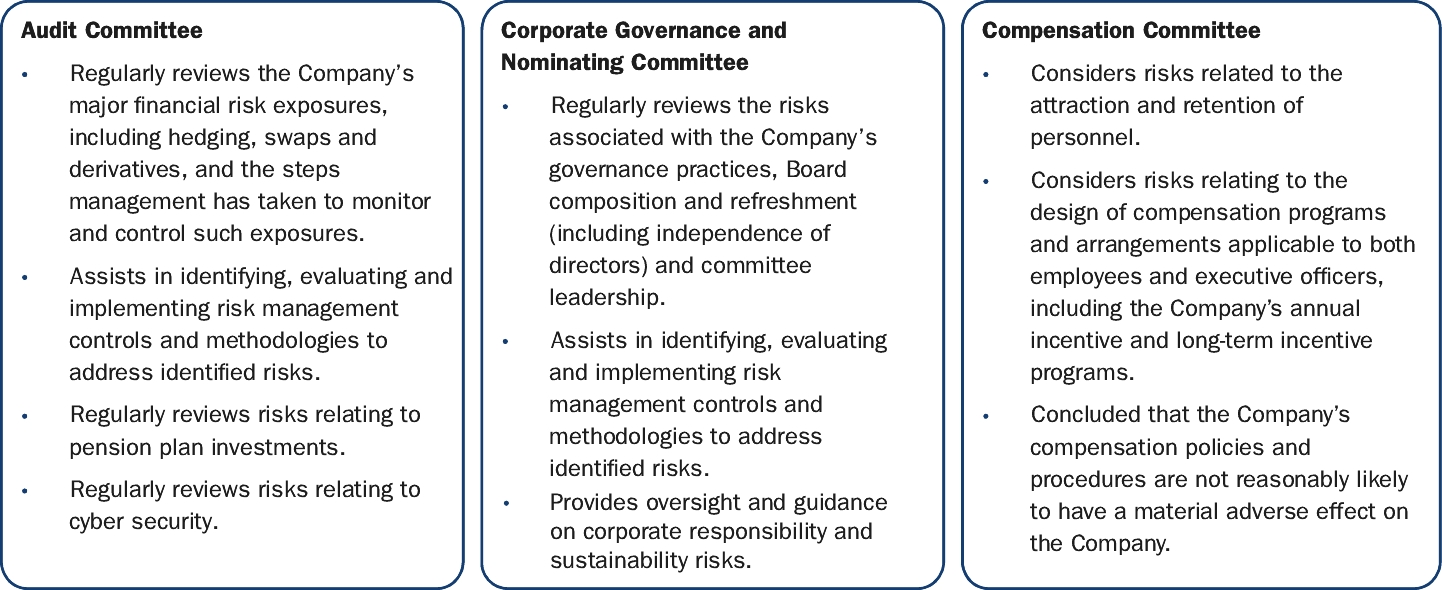

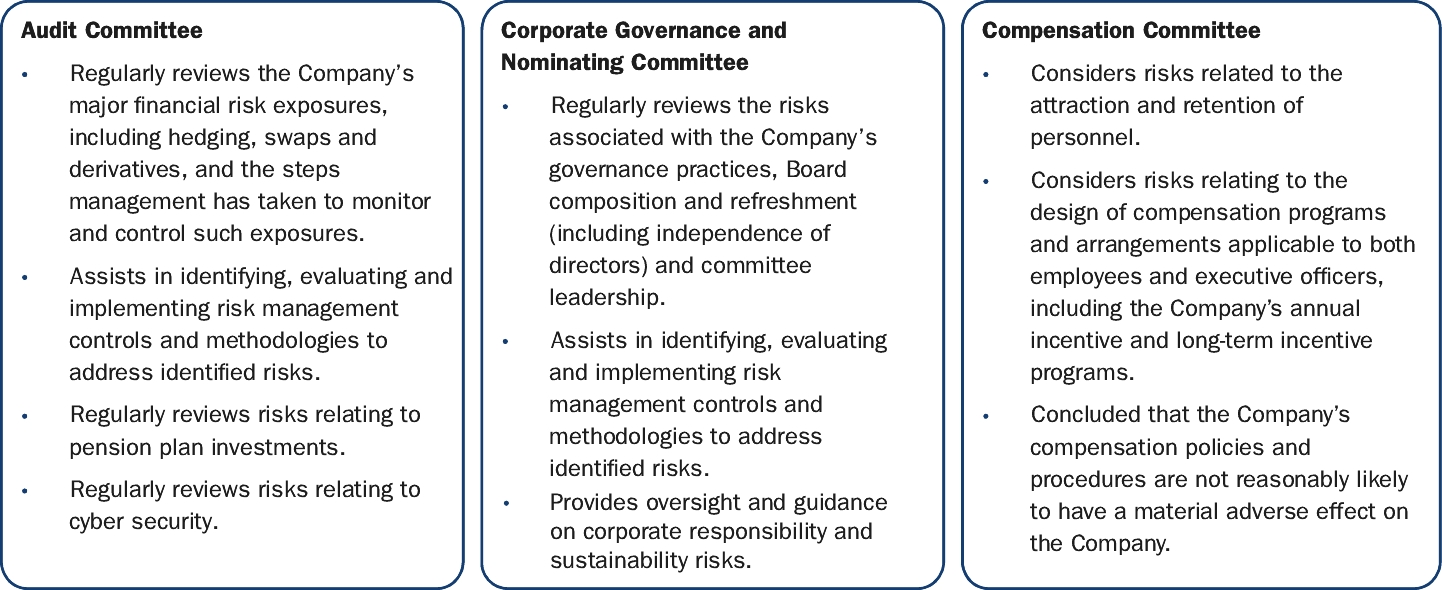

Members of the Board should have a background and experience in areas important to the operations and strategy of the Company. Experience in the following areas are among the most significant qualifications of a director: Leadership Experience: Experience as a CEO, CFO, COO, division or segment president or managing director, or other functional leadership within a large, complex organization such as ours. International Experience: Experience overseeing complex global operations in many countries, such as we have, helps us understand opportunities and challenges. TABLE OF CONTENTS Financial Literacy: Knowledge of financial reporting and complex financial transactions, as is involved with our business. Technology Experience: Experience with new technology, as we are a technology-based company that depends on our research and development capability for developing and introducing advanced new products. Relevant Industry Experience: Experience in manufacturing industries provides a relevant understanding of our business, strategy and marketplace dynamics. Governmental Experience: Experience with government helps us navigate a complex regulatory environment. Operational Experience: Experience developing and implementing operating plans with an organization as large and complex as ours. M&A/Financial Industry Experience: Experience with mergers & acquisitions and with the capital markets is important for a public company such as us. Risk Management Expertise: Experience operating in a complex risk environment which requires effective risk management, including with respect to cyber-security risks. The Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective director candidates. The Board believes that its members provide a significant composite mix of experience, knowledge and abilities that contribute to a more effective decision-making process and allow the Board to effectively fulfill its responsibilities. The Board uses a skills matrix to assist it in considering the appropriate balance of experience, skills and attributes required of a director and to be represented on the Board as a whole. The skills matrix is based on the Company’s strategic plan and is periodically reviewed. Board candidates are evaluated against the skills matrix when the Committee determines whether to recommend candidates for initial election to the Board and when determining whether to recommend currently serving directors for reelection to the Board. TABLE OF CONTENTS Summary of Director Qualifications and Experience The matrix below summarizes the key experience, qualifications and attributes of our Board. Marks indicate specific areas of expertise or focus relied on by our Board, but the lack of a mark in a particular area does not necessarily signify a director’s lack of qualification or experience in such area. See “Item 1 – 1—Election of Directors” for specific qualifications, skills and experiences of each of our directors and nominees. Board and Committee Self-Evaluation The members of the Board, and each Committee and the Board as a whole are required to conduct a self-evaluation of their performance. The evaluation process is organized by the Corporate Governance and Nominating Committee, occurs at least annually, and is re-evaluated each year to ensure it complies with current best practices. The evaluation is part of a detailed review of directors’ qualifications for re-nomination. Director Stock Ownership Requirements Under the Company’s Corporate Governance Guidelines, each director is required to own by the end of the first 36 months of service as a director and maintain throughout their service as a director: At least 400 shares of the Company’s common stock outright (excluding any stock units awarded by the Company and any unexercised stock options); and A number of shares equal to five times the then current annual cash retainer for directors (inclusive of any stock units, restricted stock or similar awards by the Company in connection with service as an employee or Director, and, if applicable, shares purchased with amounts invested in the MTI retirement plans, but excluding any unexercised stock options). As of January 31, 2020,2022, all of the Company’s directors who had served the 36 months for this requirement to apply met the requirement. TABLE OF CONTENTS The Board’s Role in Risk Oversight The Board has responsibility for risk oversight, including understanding critical risks in the Company’s business and strategy, evaluating the Company’s risk management processes, and seeing that such risk management processes are functioning adequately. It is management’s responsibility to manage risk and bring to the Board’s attention the most material risks to the Company. The Company’s management has several layers of risk oversight, including through the Company’s Strategic Risk Management Committee and Operating Risk Management Committee. Management communicates routinely with the Board, Board Committees and individual directors on the significant risks identified and how they are being managed, including formal reports by the Strategic Risk Management Committee to the Board that are at least annual. Risks are reviewed regularly by the Board as a whole at each Board meeting. The risk oversight focus areas reviewed by the Board as a whole include risks related to the Company’s capital structure, mergers and acquisitions, capital projects, andcyber-security, environmental, health and safety risks and geopolitical and associated market risks. The Board also implements its risk oversight function through Committees, which provide reports regarding their activities to the Board at each meeting. The risk oversight focus areas of the committees are:  Audit Committee• Regularly reviews the Company’s major financial risk exposures, including hedging, swaps and derivatives, and the steps management has taken to monitor and control such exposures.• Assists in identifying, evaluating and implementing risk management controls and methodologies to address identified risks.• Regularly reviews risks relating to pension plan investments.• Regularly reviews risks relating to cyber security. |

Corporate Governance and

Nominating Committee

• Regularly reviews the risks

associated with the Company’s

governance practices, Board

composition and refreshment

(including independence of

directors) and committee

leadership.

• Assists in identifying, evaluating

and implementing risk

management controls and

methodologies to address

identified risks.

|

Compensation Committee

• Considers risks related to the

attraction and retention of

personnel.

• Considers risks relating to the

design of compensation programs

and arrangements applicable to

both employees and executive

officers, including the Company’s

annual incentive and long-term

incentive programs.

• Concluded that the Company’s

compensation policies and

procedures are not reasonably likely

to have a material adverse effect on

the Company.

|

The Board’s Role in Succession Planning The Board regularly reviews plans for succession to the position of Chief Executive Officer, as well as certain other senior management positions. To assist the Board, the Chief Executive Officer annually provides the Board with an assessment of senior managers and of their potential to succeed him or her. The Chief Executive Officer also provides the Board with an assessment of persons considered potential successors to certain senior management positions. TABLE OF CONTENTS Corporate Responsibility and Sustainability Sustainability is deeply embedded into MTI’s values are rooted in sustainability.core values. We manage our operations, our capital and our business opportunities in a sustainable manner, and we place the health and safety of people ahead of everything else. The Company serves as a good steward of natural resources, and we employ sound social and environmental practices to protect the communities in which we operate. ForOver the past eleven13 years, we have issued aMTI has published an annual Corporate Responsibility and Sustainability Report outlining the Company’sthat describes our efforts in continuous improvement regarding our safety the environment,culture, environmental performance and reduction targets, social impact, onnew product development, and community engagement. We have established environmental reduction targets in six focus areas. Since establishing the workplace, financetargets in 2019, we have made significant progress—from identifying our highest-priority activities, to engaging employees across our company to adopt a more energy-efficient and operations.resource conservation mindset, to implementing a number of key projects that further improve our performance. The targets, which measure our progress against our 2018 environmental performance, are set forth below. As part of our continuous improvement mindset, we will be closely monitoring our progress to achieve these environmental targets and anticipate identifying additional or new, more stringent targets in the coming years that will further improve our environmental footprint. Progress to Achieving Environmental Reduction Targets

DIVERSITY AND INCLUSION

The Company is increasingly focused on diversity considerations. While diversityIn 2020 we made a change to our structure to improve coordination and inclusion have always beenoversight of our sustainability efforts through the creation of a key priority at MTI,distinct Lead Team, separate from its previous oversight within the Environmental, Health and Safety (EHS) Lead Team. With the creation of a dedicated Sustainability Lead Team, we have broughtare strengthening our commitment to sustainability, bringing more focusstructure to these broader efforts over the past year by establishingand providing a dedicated Diversity and Inclusion Councilplatform to advise the Chief Executive Officer on our progress in creating a work environment that values all of our employees.

The Council is responsible for determining the overall global diversity and inclusion strategybetter share best practices across the Company, whichentire company. The Sustainability Lead Team includes identifying initiatives, supporting the development of these initiatives, setting goals and measuring results / progress. The committee comprises employees across gender, ethnicity, business function, geographies and experiences to ensure we have a comprehensive mix of individuals and viewpoints.

The primary focuses of the Council over the past year has been the selection and execution of a diversity and inclusion training program for senior leaders from various functional areas of expertise across our global footprint and surveying employee perspectives onmeets regularly. The Sustainability Lead Team and its environmental management system reports directly to the current stateCEO and directly interacts with the Board of diversityDirectors, Leadership Council, and inclusion at MTI.business leaders. We focus on continuous improvement in all facets of our business—processes, systems, products, services, people, cost reduction, productivity, mining and productivity.reclamation, and elimination of waste. As illustrateddescribed further below, in our Global Corporate Governance diagram, Minerals Technologies has seven culture-based lead teams dedicated to the environment, health and safety, operational excellence, technology and innovation, diversity and inclusion, mining, expense reductionoptimization, and sustainable growth. These cross-functional lead teams report directly to the Chief Executive Officer and are assisted by a senior executive appointed to bring additional expertise. In addition to receiving detailed information on the Company’s financial and operating performance, financial position and capital allocation, succession planning, and risk assessment, among other subjects, the Board of Directors receives performance metrics and updates on a monthly basis from all of the lead teams. In particular, the Board is provided with a comprehensive safety and environmental briefing each quarter at Board meetings, and receives the following information each TABLE OF CONTENTS The Board is provided with regular reports on the lead teams’ activities. In particular, the Board is provided with a comprehensive safety briefing each quarter at Board meetings, and receives the following safety information each month: recordable injury rate, lost workday injury rate, injury details by business unit and geographic region, sustainability initiatives including environmental releases / performance against emission reduction targets, safety initiatives and policies. At least once a year, the Board receives detailed reviews from the Lead Teams on current status, progress, metrics and future plans for strategic discussions with our CEO.